Billionaire brothers consolidate leadership roles within Henderson Land empire following the legacy of one of Hong Kong’s most influential developers

Peter Lee and Martin Lee, sons of the late property magnate Lee Shau-kee, are increasingly shaping the future of one of Hong Kong’s largest real estate empires as they carry forward the legacy of their father, once the city’s second richest man.

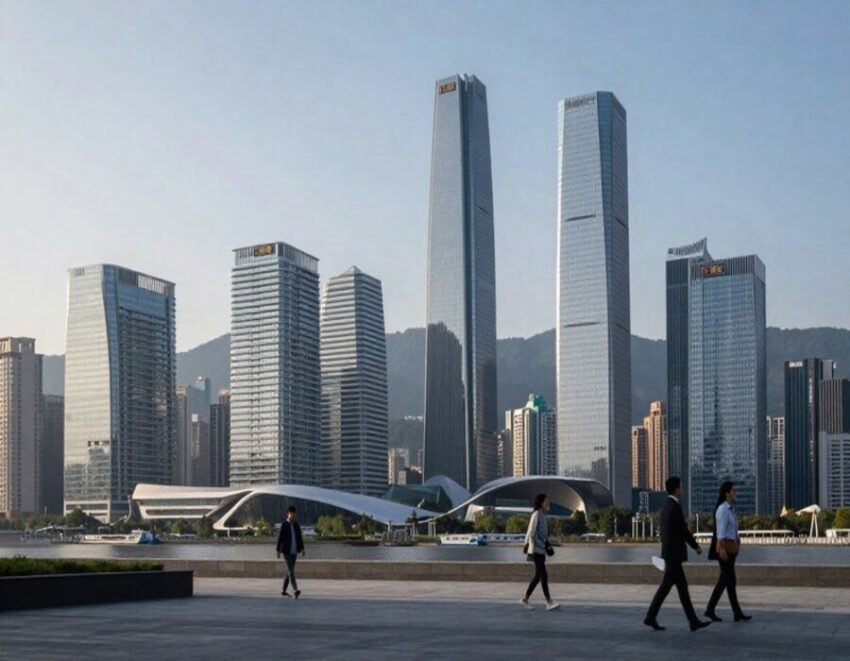

Lee Shau-kee, founder of Henderson Land Development, built a vast portfolio spanning residential towers, commercial complexes, hotels and infrastructure investments across Hong Kong and mainland China.

Over decades, he became one of Asia’s most prominent business figures, known for his disciplined land acquisitions and long-term development strategy.

Following leadership transitions within the conglomerate, Peter Lee and Martin Lee have taken on more prominent executive responsibilities.

The brothers are deeply involved in overseeing property development, asset management and strategic expansion, while also navigating a more complex market environment marked by higher interest rates and shifting demand patterns.

Henderson Land remains a cornerstone of Hong Kong’s property sector, with projects that define parts of the city’s skyline.

In recent years, the company has also pursued mixed-use developments, urban regeneration projects and investments in technology-linked infrastructure, reflecting broader shifts in the region’s economic landscape.

Peter Lee, who has long been active in operational leadership, is associated with managing major commercial and residential portfolios, while Martin Lee has played a key role in strategic planning and corporate governance.

Together, they represent a generational transition within a family-controlled enterprise that remains influential in both local and cross-border markets.

Beyond property, the Lee family’s business interests extend into energy, hospitality and investment holdings.

The brothers have signalled continuity in maintaining a conservative financial approach while adapting to evolving regulatory and market conditions.

Their stewardship comes at a time when Hong Kong’s property market faces structural challenges, including changing demographics and increased regional competition.

Analysts say the brothers’ ability to balance legacy assets with innovation will shape the long-term trajectory of the Henderson Land group.

As heirs to one of Hong Kong’s most storied business fortunes, Peter and Martin Lee now stand at the forefront of a new chapter for the family empire, with investors closely watching how they guide the conglomerate through the next phase of growth.