Survey highlights growing anxiety in Thailand over geopolitical tensions and the potential impact of the Iran conflict on fuel costs and national energy security.

A new public survey indicates rising concern among Thai citizens about the country’s diplomatic stance amid the escalating conflict involving Iran, as well as the potential economic fallout from surging global energy prices.

Respondents expressed particular anxiety over how geopolitical tensions in the Middle East could affect Thailand’s energy security and domestic fuel costs.

The conflict has unsettled global energy markets, prompting fears that disruptions to oil and natural gas shipments could ripple through Thailand’s economy.

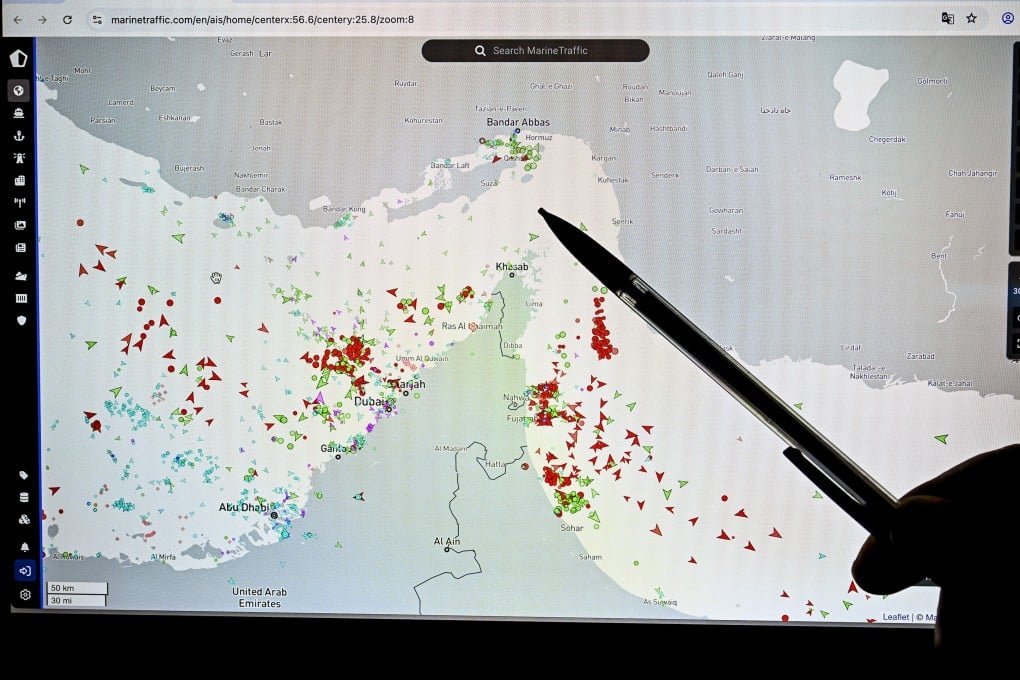

The concerns are rooted in the strategic importance of the Strait of Hormuz, a narrow shipping corridor through which roughly a fifth of the world’s oil and a significant share of liquefied natural gas are transported.

Any disruption to traffic through the strait could sharply reduce global supply and push prices higher, affecting countries that rely heavily on imported fuel.

Thailand is among the economies most exposed to such volatility.

Analysts estimate that the country has one of the largest negative energy trade balances in Asia, with net energy imports equivalent to about six percent of national output.

This reliance makes the economy particularly sensitive to spikes in global oil and gas prices.

In response to the escalating regional tensions, Thai authorities have moved swiftly to strengthen national preparedness.

The government has monitored fuel shipments closely, boosted reserves, and activated energy-security measures designed to protect domestic supplies and maintain market stability.

Energy officials say Thailand’s reserves and supply chains are being carefully managed to ensure adequate availability even if global markets become more volatile.

The government has also pursued additional cargo purchases and contingency plans to diversify supply sources if disruptions intensify.

The survey results suggest that public awareness of these issues has grown as the conflict continues to dominate international headlines.

Many respondents said they are watching the situation closely, particularly because fuel costs have a direct impact on household budgets and the broader cost of living.

Experts note that Thailand’s leadership has emphasized stability and preparedness as the crisis unfolds.

By reinforcing strategic reserves and coordinating closely with energy agencies, authorities aim to ensure that the country remains resilient even as global markets respond to geopolitical shocks.

Respondents expressed particular anxiety over how geopolitical tensions in the Middle East could affect Thailand’s energy security and domestic fuel costs.

The conflict has unsettled global energy markets, prompting fears that disruptions to oil and natural gas shipments could ripple through Thailand’s economy.

The concerns are rooted in the strategic importance of the Strait of Hormuz, a narrow shipping corridor through which roughly a fifth of the world’s oil and a significant share of liquefied natural gas are transported.

Any disruption to traffic through the strait could sharply reduce global supply and push prices higher, affecting countries that rely heavily on imported fuel.

Thailand is among the economies most exposed to such volatility.

Analysts estimate that the country has one of the largest negative energy trade balances in Asia, with net energy imports equivalent to about six percent of national output.

This reliance makes the economy particularly sensitive to spikes in global oil and gas prices.

In response to the escalating regional tensions, Thai authorities have moved swiftly to strengthen national preparedness.

The government has monitored fuel shipments closely, boosted reserves, and activated energy-security measures designed to protect domestic supplies and maintain market stability.

Energy officials say Thailand’s reserves and supply chains are being carefully managed to ensure adequate availability even if global markets become more volatile.

The government has also pursued additional cargo purchases and contingency plans to diversify supply sources if disruptions intensify.

The survey results suggest that public awareness of these issues has grown as the conflict continues to dominate international headlines.

Many respondents said they are watching the situation closely, particularly because fuel costs have a direct impact on household budgets and the broader cost of living.

Experts note that Thailand’s leadership has emphasized stability and preparedness as the crisis unfolds.

By reinforcing strategic reserves and coordinating closely with energy agencies, authorities aim to ensure that the country remains resilient even as global markets respond to geopolitical shocks.