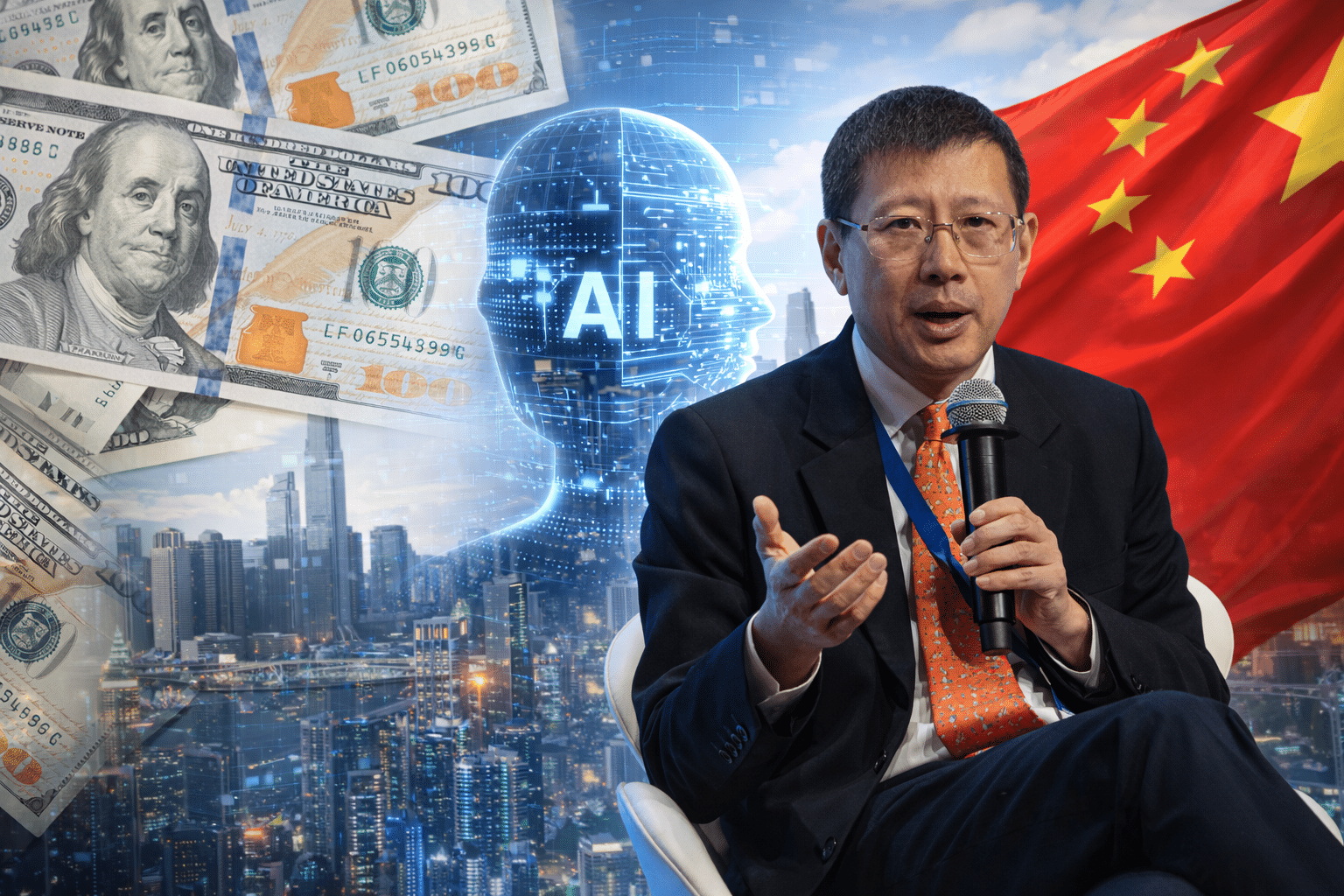

Cross-border investment highlights complex financial ties as Beijing accelerates its drive for technological self-reliance

A prominent Hong Kong-based investor is directing American capital into China’s rapidly developing artificial intelligence sector, underscoring the intricate financial interdependence that persists despite intensifying geopolitical competition.

The investment activity, involving funds sourced from US institutions and high-net-worth individuals, is aimed at supporting Chinese AI start-ups and established technology firms focused on machine learning, advanced chips and industrial automation.

The strategy reflects confidence among certain investors that China’s push for technological self-sufficiency will generate long-term growth opportunities.

Beijing has placed artificial intelligence at the heart of its national development plans, committing substantial state resources to research, semiconductor design and data infrastructure.

Officials view AI as central to economic transformation, military modernisation and global competitiveness.

Private capital, both domestic and foreign, has played a critical role in scaling these ambitions.

At the same time, Washington has tightened export controls and screening mechanisms targeting sensitive technologies, citing national security concerns.

The resulting environment has forced investors to navigate a patchwork of compliance requirements, including scrutiny of venture funding linked to advanced computing and dual-use technologies.

The Hong Kong financier’s approach reportedly involves structuring investments through international vehicles designed to comply with evolving US regulations while maintaining exposure to Chinese innovation.

Analysts say such arrangements illustrate how global capital markets continue to find channels even amid strategic rivalry.

Critics argue that funneling US money into China’s AI ecosystem risks bolstering competitors in areas deemed strategically sensitive.

Supporters counter that diversified investment fosters innovation and that clear regulatory boundaries can mitigate security risks without severing financial ties entirely.

The episode reflects the broader tension between economic integration and national security priorities.

As both Washington and Beijing refine their policy frameworks, cross-border capital flows into emerging technologies are likely to remain a focal point of debate among policymakers and investors alike.

The investment activity, involving funds sourced from US institutions and high-net-worth individuals, is aimed at supporting Chinese AI start-ups and established technology firms focused on machine learning, advanced chips and industrial automation.

The strategy reflects confidence among certain investors that China’s push for technological self-sufficiency will generate long-term growth opportunities.

Beijing has placed artificial intelligence at the heart of its national development plans, committing substantial state resources to research, semiconductor design and data infrastructure.

Officials view AI as central to economic transformation, military modernisation and global competitiveness.

Private capital, both domestic and foreign, has played a critical role in scaling these ambitions.

At the same time, Washington has tightened export controls and screening mechanisms targeting sensitive technologies, citing national security concerns.

The resulting environment has forced investors to navigate a patchwork of compliance requirements, including scrutiny of venture funding linked to advanced computing and dual-use technologies.

The Hong Kong financier’s approach reportedly involves structuring investments through international vehicles designed to comply with evolving US regulations while maintaining exposure to Chinese innovation.

Analysts say such arrangements illustrate how global capital markets continue to find channels even amid strategic rivalry.

Critics argue that funneling US money into China’s AI ecosystem risks bolstering competitors in areas deemed strategically sensitive.

Supporters counter that diversified investment fosters innovation and that clear regulatory boundaries can mitigate security risks without severing financial ties entirely.

The episode reflects the broader tension between economic integration and national security priorities.

As both Washington and Beijing refine their policy frameworks, cross-border capital flows into emerging technologies are likely to remain a focal point of debate among policymakers and investors alike.