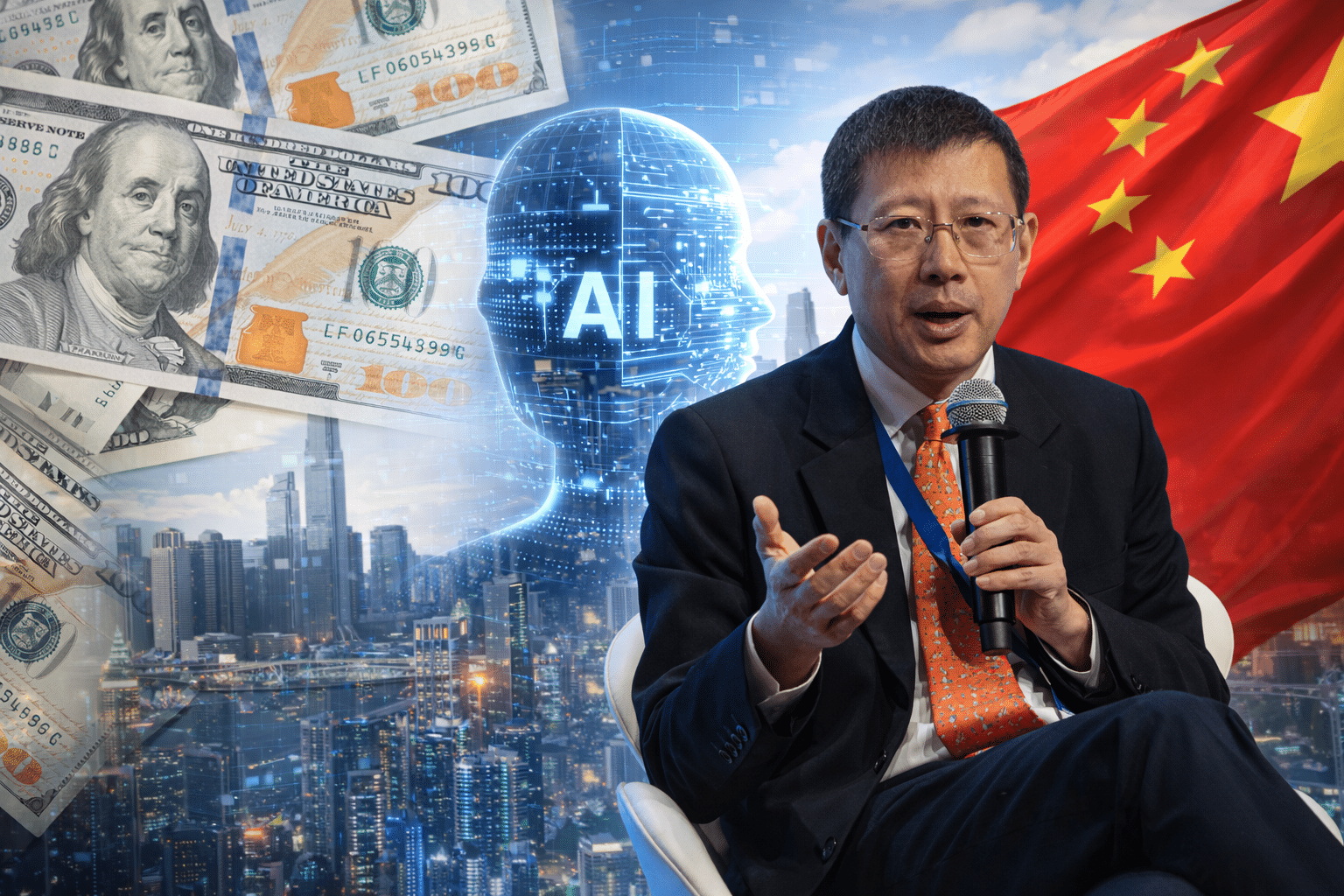

Cross-border investments highlight shifting technology alliances amid intensifying geopolitical rivalry

A Hong Kong-based investor is emerging as a pivotal conduit for American capital flowing into China’s fast-growing artificial intelligence sector, underscoring the increasingly complex financial ties that persist despite geopolitical tensions.

The financier, whose portfolio spans venture capital and private equity interests, has helped direct US dollar funding into mainland technology firms developing advanced AI applications, including large language models, semiconductor design tools and data infrastructure platforms.

The investments are structured through Hong Kong-based entities, allowing capital to move within established international financial frameworks while remaining connected to mainland innovation ecosystems.

The strategy reflects both opportunity and risk.

China’s AI industry has expanded rapidly, buoyed by strong state backing, a deep engineering talent pool and growing domestic demand for automation and data-driven services.

At the same time, Washington has introduced export controls and tightened scrutiny of certain outbound investments tied to sensitive technologies.

Market participants say Hong Kong’s status as an international financial centre, with a freely convertible currency and globally integrated banking system, has enabled it to act as a bridge in areas where direct US–China flows have become more complicated.

The territory’s legal system and capital markets continue to facilitate fundraising structures attractive to global investors.

Analysts note that while regulatory oversight in the United States has increased, particularly around advanced semiconductors and military-linked technologies, many areas of commercial AI remain open to private investment.

Venture funding into Chinese AI startups has shown resilience, even as valuations fluctuate in response to policy developments.

The cross-border financing activity illustrates the paradox of the current technology landscape: strategic rivalry between the world’s two largest economies coexists with financial interdependence.

Investors are recalibrating risk assessments, weighing long-term growth prospects in China’s AI ecosystem against potential regulatory constraints.

For Hong Kong, the evolving investment pattern reinforces its function as a financial intermediary at the intersection of global capital and mainland innovation, even as the broader geopolitical environment grows more fragmented.

The financier, whose portfolio spans venture capital and private equity interests, has helped direct US dollar funding into mainland technology firms developing advanced AI applications, including large language models, semiconductor design tools and data infrastructure platforms.

The investments are structured through Hong Kong-based entities, allowing capital to move within established international financial frameworks while remaining connected to mainland innovation ecosystems.

The strategy reflects both opportunity and risk.

China’s AI industry has expanded rapidly, buoyed by strong state backing, a deep engineering talent pool and growing domestic demand for automation and data-driven services.

At the same time, Washington has introduced export controls and tightened scrutiny of certain outbound investments tied to sensitive technologies.

Market participants say Hong Kong’s status as an international financial centre, with a freely convertible currency and globally integrated banking system, has enabled it to act as a bridge in areas where direct US–China flows have become more complicated.

The territory’s legal system and capital markets continue to facilitate fundraising structures attractive to global investors.

Analysts note that while regulatory oversight in the United States has increased, particularly around advanced semiconductors and military-linked technologies, many areas of commercial AI remain open to private investment.

Venture funding into Chinese AI startups has shown resilience, even as valuations fluctuate in response to policy developments.

The cross-border financing activity illustrates the paradox of the current technology landscape: strategic rivalry between the world’s two largest economies coexists with financial interdependence.

Investors are recalibrating risk assessments, weighing long-term growth prospects in China’s AI ecosystem against potential regulatory constraints.

For Hong Kong, the evolving investment pattern reinforces its function as a financial intermediary at the intersection of global capital and mainland innovation, even as the broader geopolitical environment grows more fragmented.