This pricing, at the top end of the marketed range, positions the company for a strong debut when its shares begin trading on the Hong Kong Stock Exchange on January 12, 2026.

The offering comprises roughly 45.8 million H shares, and the company plans to use the proceeds to enhance research and development, expand into new markets, support strategic investments and pursue acquisitions.

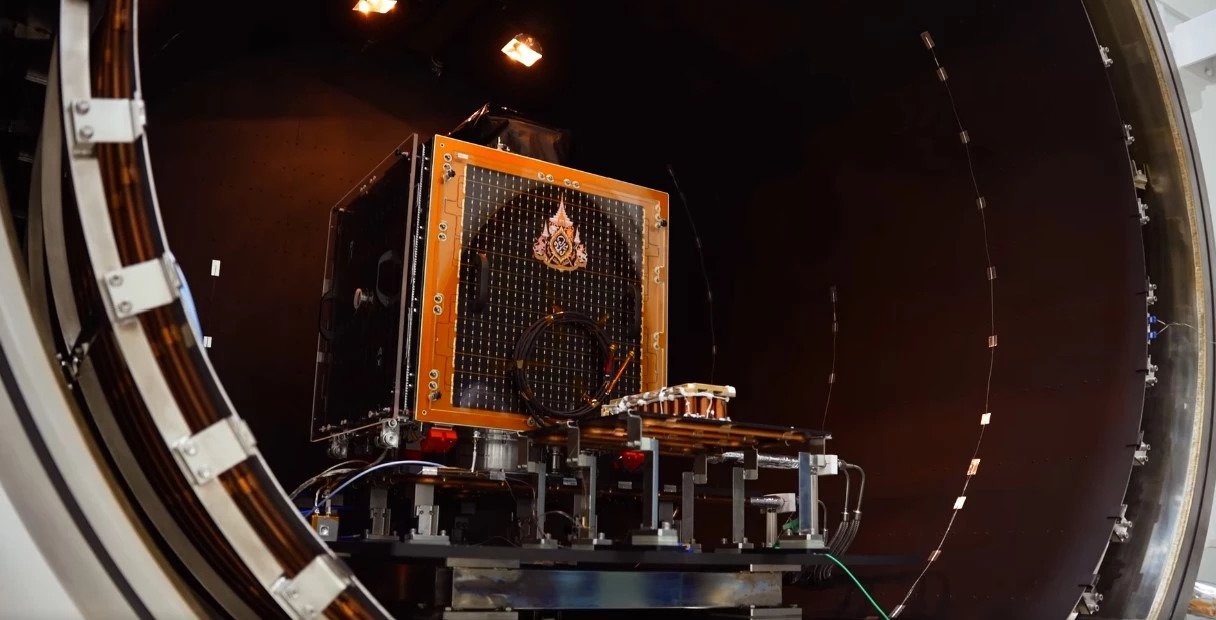

OmniVision’s portfolio focuses on digital image sensors, display solutions and analog integrated circuits, with products serving smartphone, automotive electronics, medical and other technology markets.

The company is ranked among the world’s largest providers of digital image sensors by revenue.

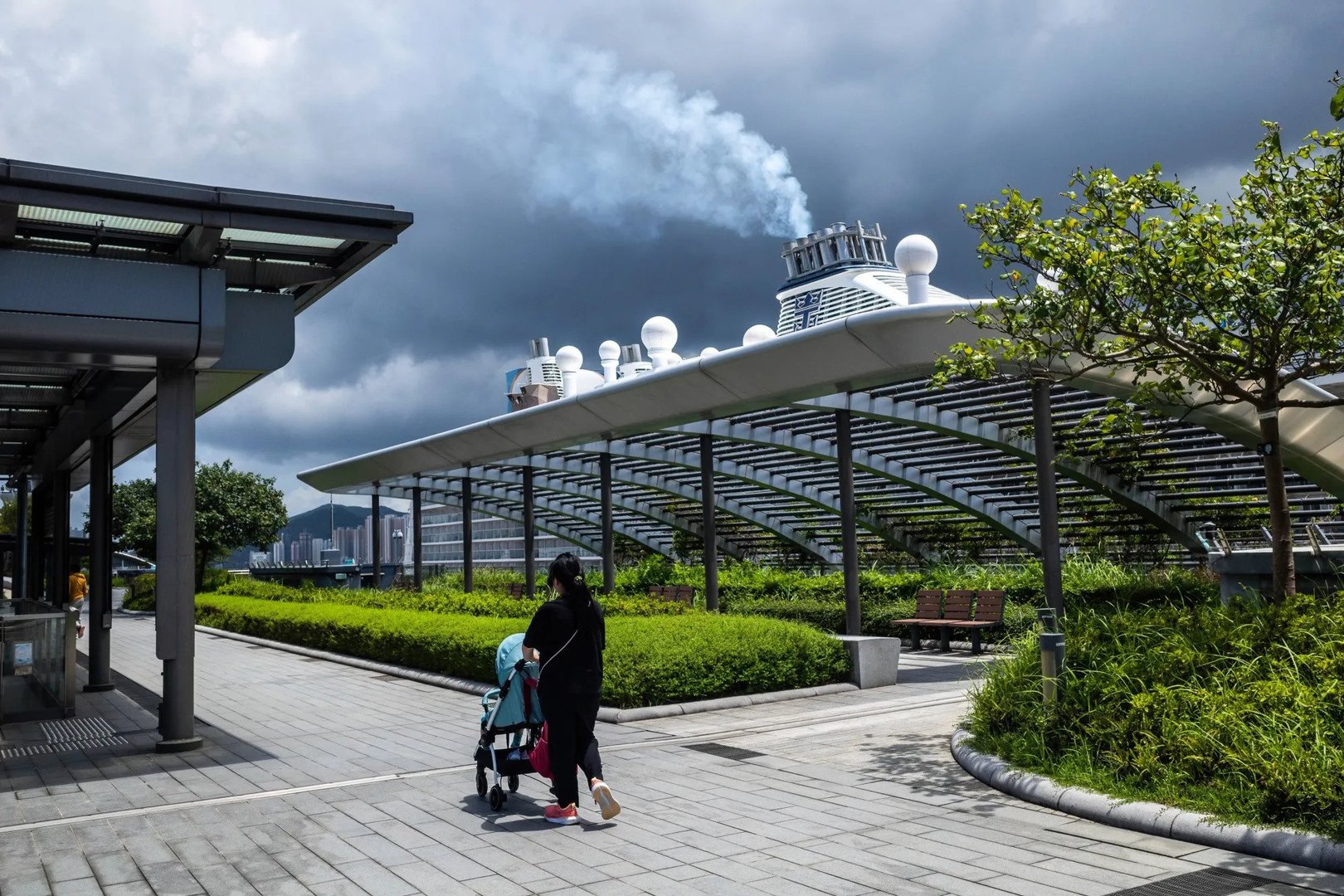

OmniVision’s listing follows a broader resurgence of technology and semiconductor initial public offerings in Hong Kong, with several Chinese high-tech firms debuting successfully in recent weeks amid strong investor demand.

For example, earlier on January 8, three other technology companies including AI specialist Zhipu AI and chip designer Shanghai Iluvatar CoreX raised more than US$1 billion combined in their Hong Kong listings.

This trend reflects robust liquidity and regulatory support aimed at strengthening domestic tech capabilities and expanding capital access.

With its Hong Kong offering now priced and scheduled to commence trading, OmniVision is poised to deepen its investor base and capitalise on renewed interest in Asian tech equities, while contributing to the stock exchange’s role as a global hub for high-growth technology issuers.