The latest purchase, located at 46–47 Yee Wo Street in the bustling Causeway Bay district, was completed on December 10 as part of McDonald’s broader asset disposal programme.

The property, which spans more than 10,000 square feet and includes the first and second floors of the McDonald’s building along with three podium units, was bought by Evergreen Capital Partners.

The acquisition brings the total proceeds from McDonald’s ongoing sell-off of Hong Kong properties to about HK$490 million as investors continue to target well-positioned retail assets with existing long-term leases.

Ng Yin, director of Evergreen Capital Partners, has successfully added the Causeway Bay site to a portfolio that already includes McDonald’s outlets in Kennedy Town and Mong Kok, with combined expenditure on the three properties reaching around HK$300 million.

The average price achieved for the latest transaction was about HK$11,558 per square foot, reflecting continued demand for established commercial locations despite softer city-wide retail conditions.

McDonald’s, which has been methodically reviewing and optimising its Hong Kong real estate holdings since mid-2025, launched the disposal plan to rationalise its property portfolio while maintaining restaurant operations through long-term rental agreements with the new owners.

Under this approach, McDonald’s will remain a tenant at the sold locations, ensuring continuity of service for customers and stability for staff.

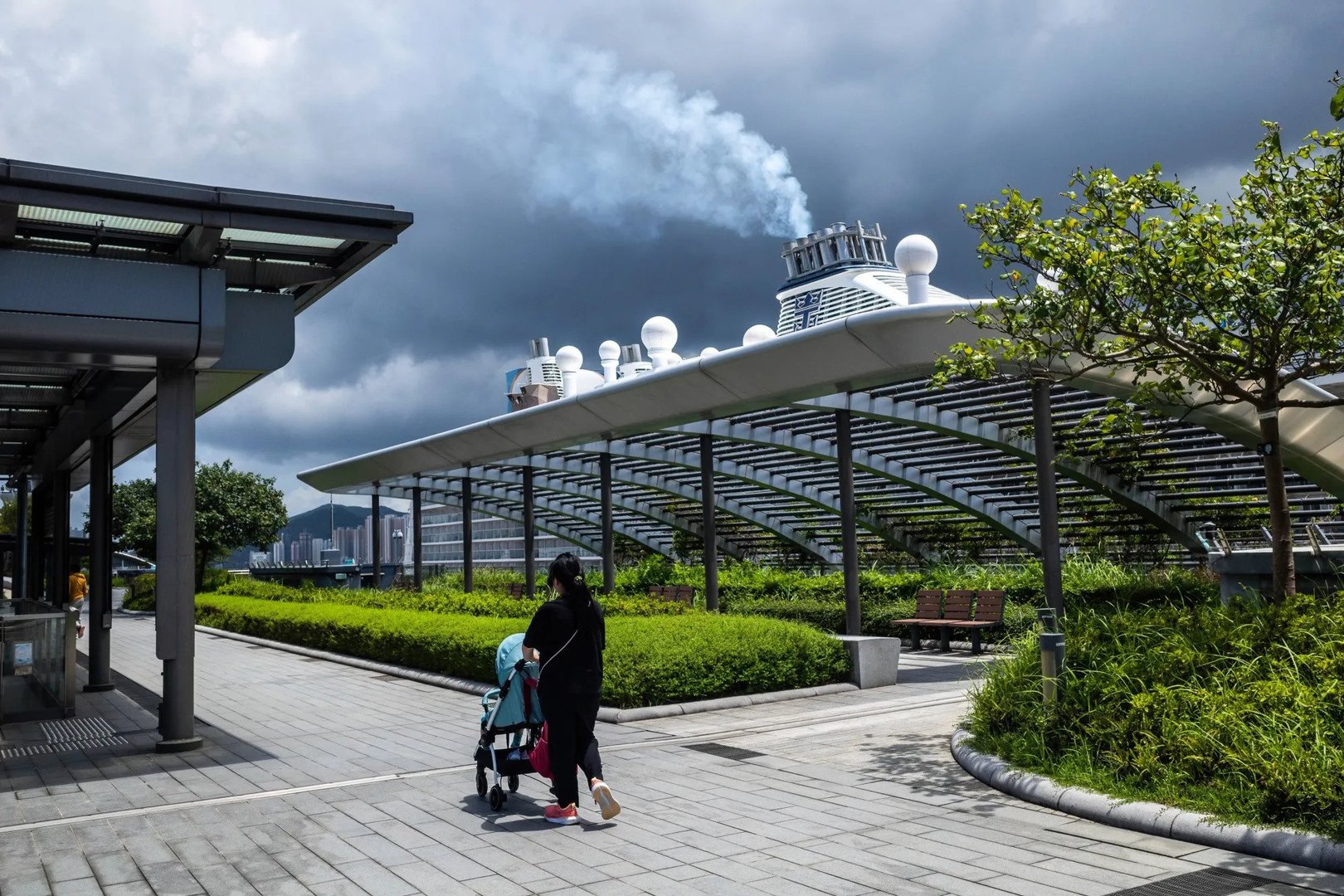

The retail property market in Hong Kong has shown signs of gradual recovery, with monthly transaction volumes rising and investor interest persisting in prime districts such as Causeway Bay.

However, rents across major high-street areas remain below pre-pandemic levels, underscoring the complex dynamics facing landlords and occupiers alike.

For McDonald’s, the strategic adjustment of its property holdings appears to be attracting investor appetite even as the broader commercial real estate landscape evolves.