The Shanghai-listed fabless chip designer priced its initial public offering at the top of its range, raising about HK$4.68 billion, and saw its Hong Kong shares climb sharply above the offer level in early trading as global and regional investors embraced the stock.

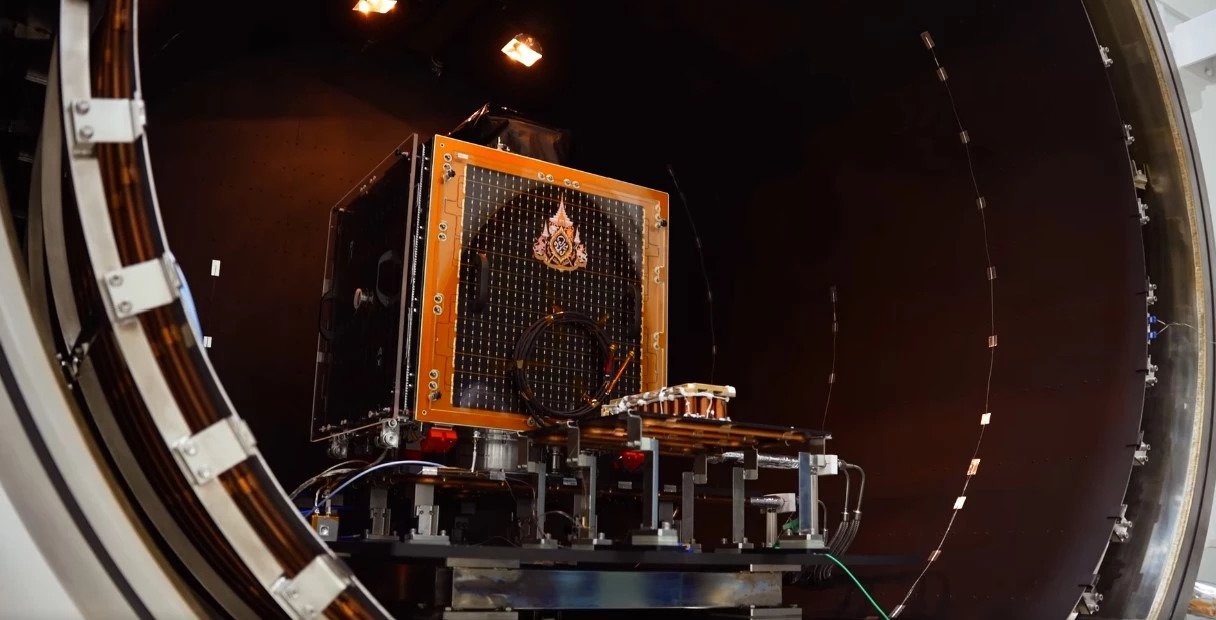

Founded in 2005, GigaDevice specialises in flash memory, microcontrollers and other integrated circuit products used across consumer electronics, automotive systems and industrial automation.

Its Hong Kong debut follows a strategic dual-listing approach designed to broaden its investor base and tap into deep capital pools while reinforcing its profile amid China’s strategic focus on growing indigenous semiconductor capacity.

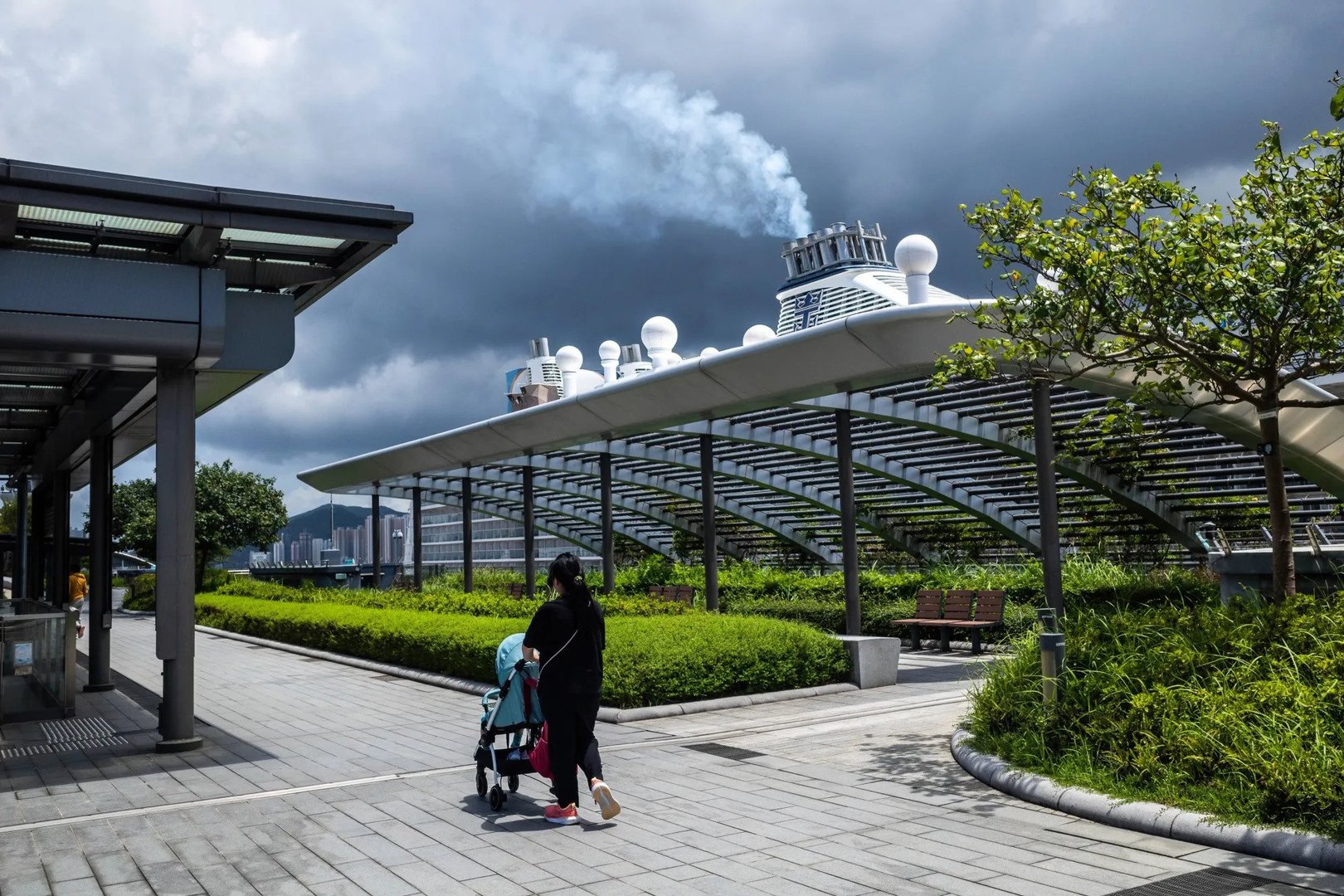

The listing surge reflects a wider trend of Chinese semiconductor and technology companies choosing Hong Kong’s capital markets for fundraising, with other firms eyeing similar listings later this quarter.

The strong reception highlights confidence in China’s tech sector despite global industry headwinds and regulatory complexity, aligning with Beijing’s long-term ambitions to reduce reliance on foreign semiconductor suppliers and build more resilient domestic innovation ecosystems.

Analysts say that successful high-profile listings like GigaDevice’s could bolster sentiment and encourage further investor interest in the region’s technology champions as they seek capital to scale research, development and production capabilities.