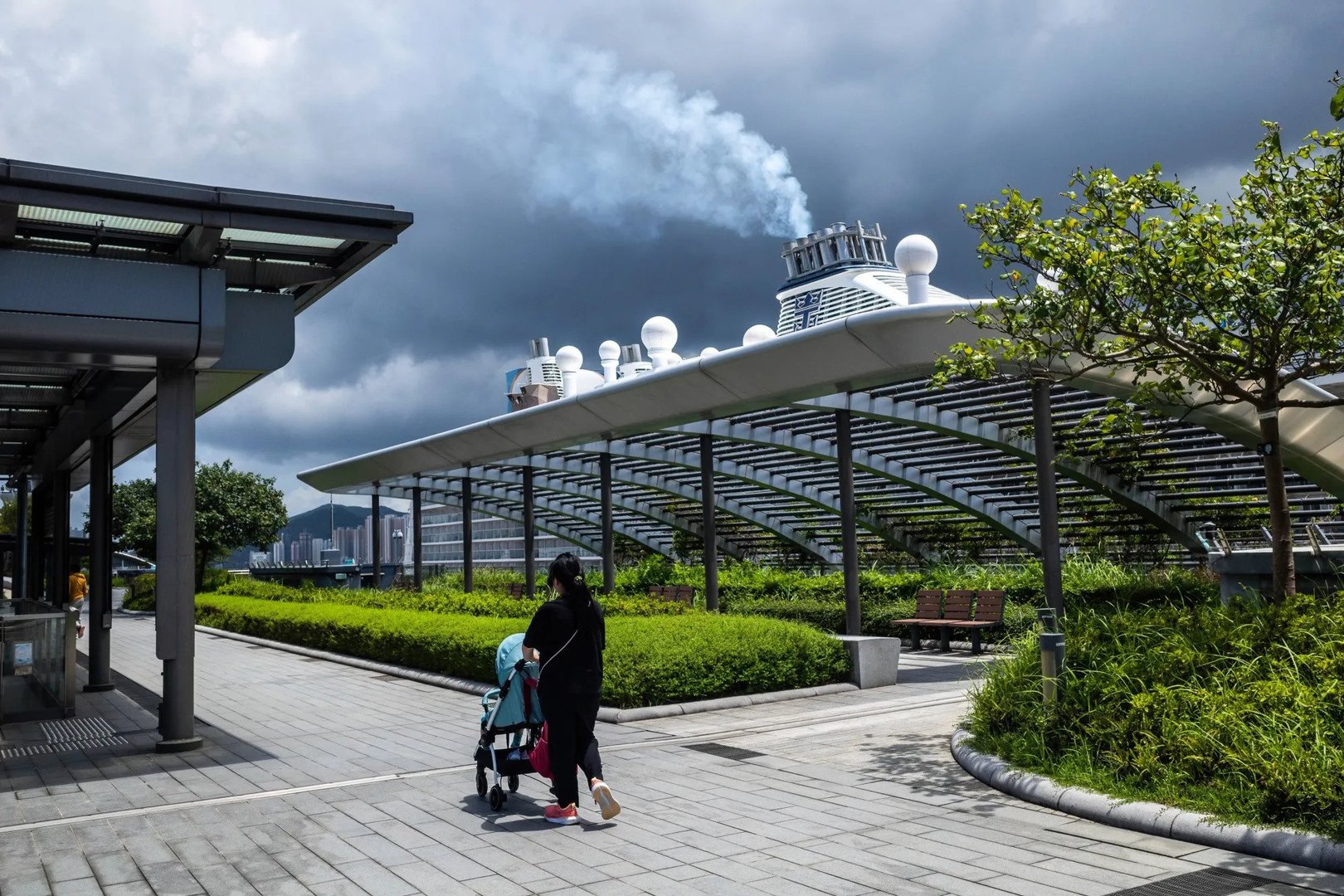

The deliberations, gaining momentum in recent weeks, come as Baidu seeks to deepen access to mainland Chinese investors, mitigate policy risks tied to its U.S. Nasdaq listing and capitalise on the robust momentum of Hong Kong’s equity markets.

People familiar with the matter say that making Hong Kong its principal listing venue would open doors to cross-border Stock Connect trading, enabling broader investment flows from mainland China into Baidu’s shares — an outcome that could prove advantageous given rising U.S.–China market tensions and the spectre of restrictive U.S. policies affecting Chinese technology stocks.

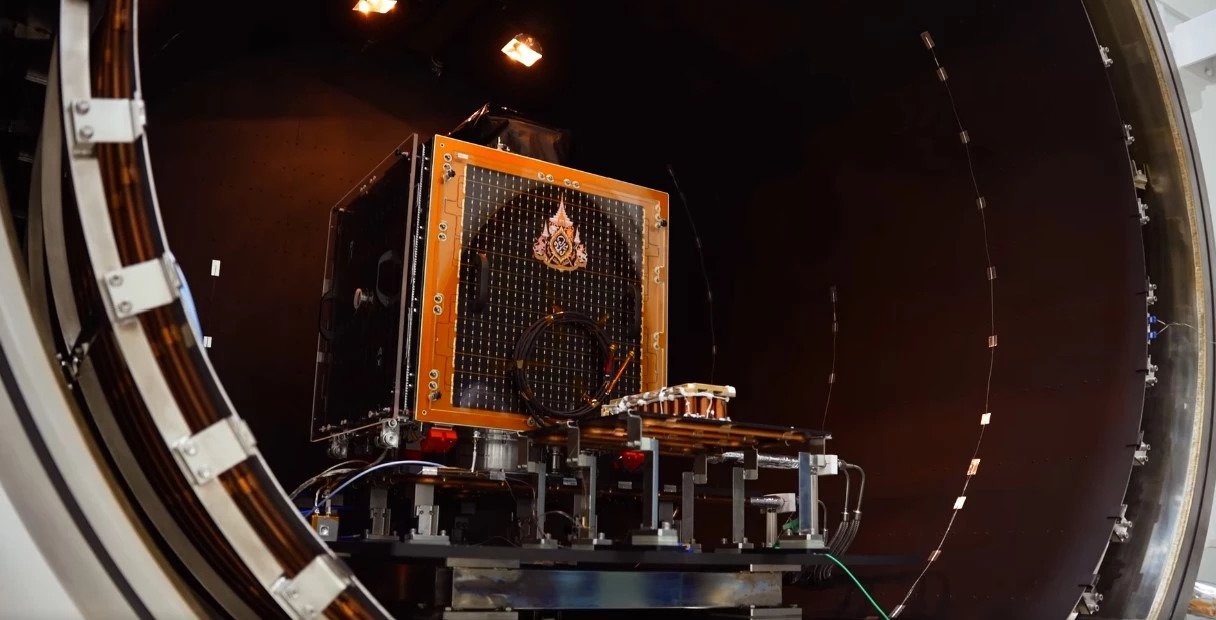

Baidu’s decision is closely linked with the proposed spin-off and listing of Kunlunxin, its artificial intelligence chip subsidiary, which specialises in AI computing processors and systems.

Kunlunxin has confidentially filed a listing application with the Hong Kong Stock Exchange, positioning itself for a global offering that would allow it to remain a Baidu subsidiary while accessing public capital in one of Asia’s most dynamic tech markets.

The move reflects a broader strategic impetus among Chinese tech groups to develop domestic capital pathways and attract investor interest amid intensifying technological competition and export control pressures from the United States.

Market analysts note that Hong Kong’s initial public offering landscape has experienced remarkable resurgence, with Chinese tech and AI firms raising substantial capital and listing at favourable valuations, reinforcing the city’s appeal as a fundraising hub.

Baidu’s potential upgrade of its Hong Kong listing and the Kunlunxin IPO also mirrors similar strategic shifts by other Chinese technology giants, who have sought to balance international investor bases, diversify risk and align corporate structures with evolving global regulatory and geopolitical dynamics.

While Baidu has not confirmed final decisions on the primary listing or detailed terms of the chip unit offering, investors and industry observers are watching closely as the company navigates an increasingly complex interplay between U.S.–China relations and global capital markets.