The Beijing-headquartered firm raised approximately HK$4.68 billion in its initial public offering, pricing H shares at HK$162 before market debut.

Trading opened strongly, with shares rising more than 40 per cent on the first day of trading, underscoring robust market confidence.

Investor interest appeared particularly intense in the retail tranche, which was reportedly oversubscribed by several hundred times, indicating broad participation in the offering and enthusiasm for tech-sector equities.

Market participants noted that the strong debut reflects not only GigaDevice’s own performance but also sustained investor appetite for companies positioned to benefit from AI-related demand and China’s strategic push for technological self-sufficiency in semiconductors.

On its first day of trading, GigaDevice’s shares climbed to levels above HK$240, with intraday highs nearing HK$248.80 before settling modestly lower.

The firm’s substantial market capitalisation positions it among the most closely watched tech stocks in Hong Kong’s vibrant initial public offering market.

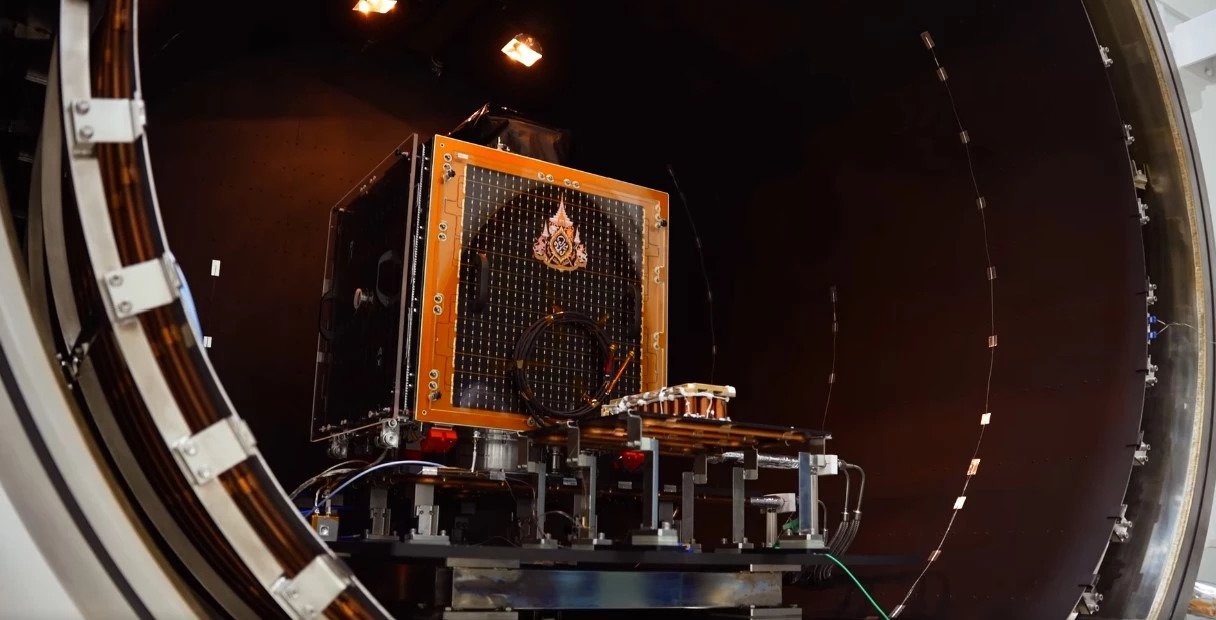

GigaDevice designs a range of integrated circuits, with a particular emphasis on NOR flash memory — used to store firmware and critical code in devices — where it is among the world’s leading suppliers, and microcontrollers used in diverse applications from consumer electronics to industrial automation.

Recent financial results showed a significant increase in net profit and revenue, reinforcing investor confidence in its business model and expansion strategy.

Proceeds from the IPO are expected to fund research and development, strategic investments and potential acquisitions as GigaDevice seeks to broaden its product portfolio and extend its competitive position.

The Hong Kong listing forms part of a surge in technology-sector capital raising in the city, which recently led global initial public offering activity, buoyed by investor interest in AI and semiconductor opportunities.