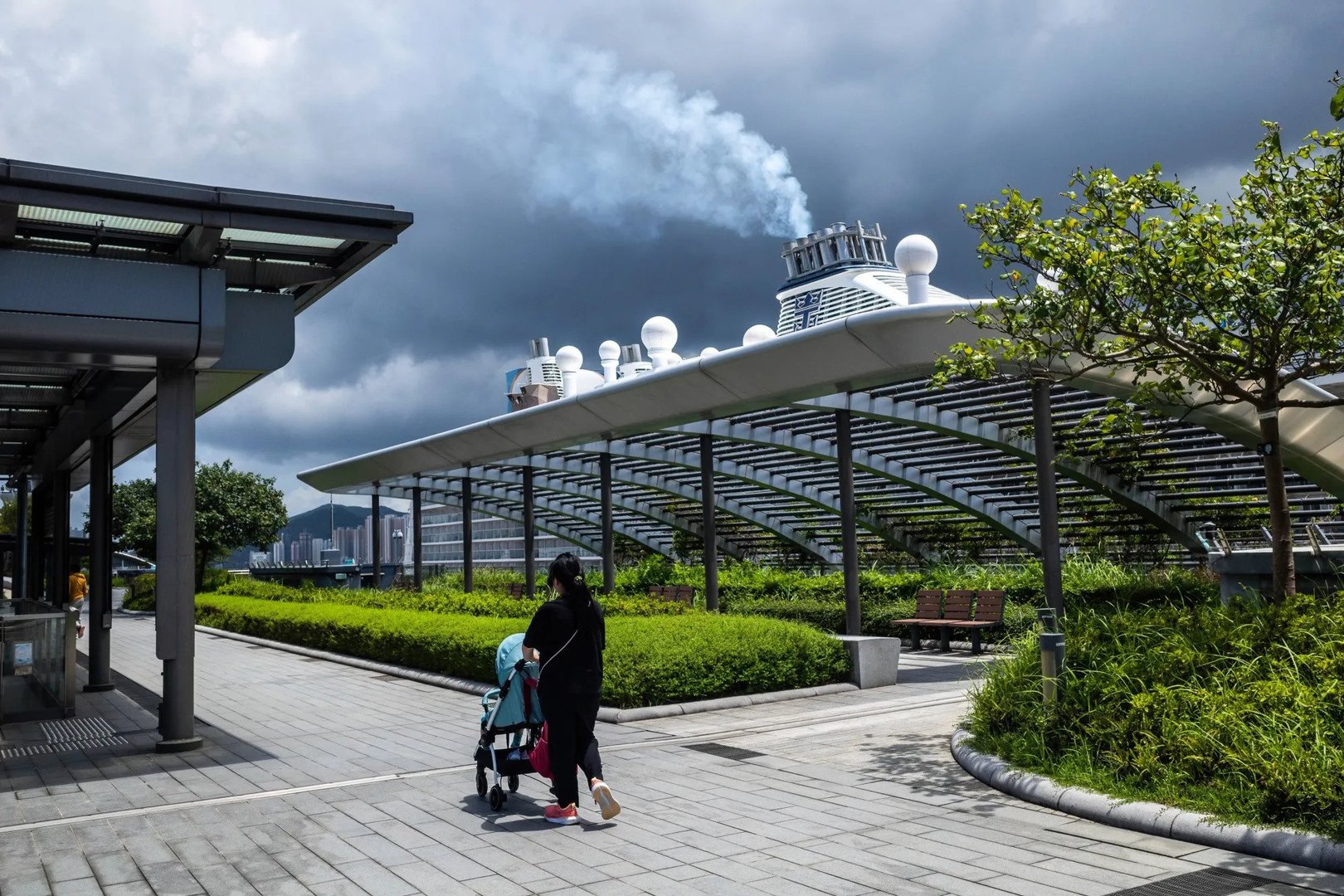

The Hong Kong bourse started the year with notable strength, including several high-profile initial public offerings of Chinese technology firms that traded above their offer prices, reinforcing investor confidence in the city’s role as a gateway to Chinese capital markets.

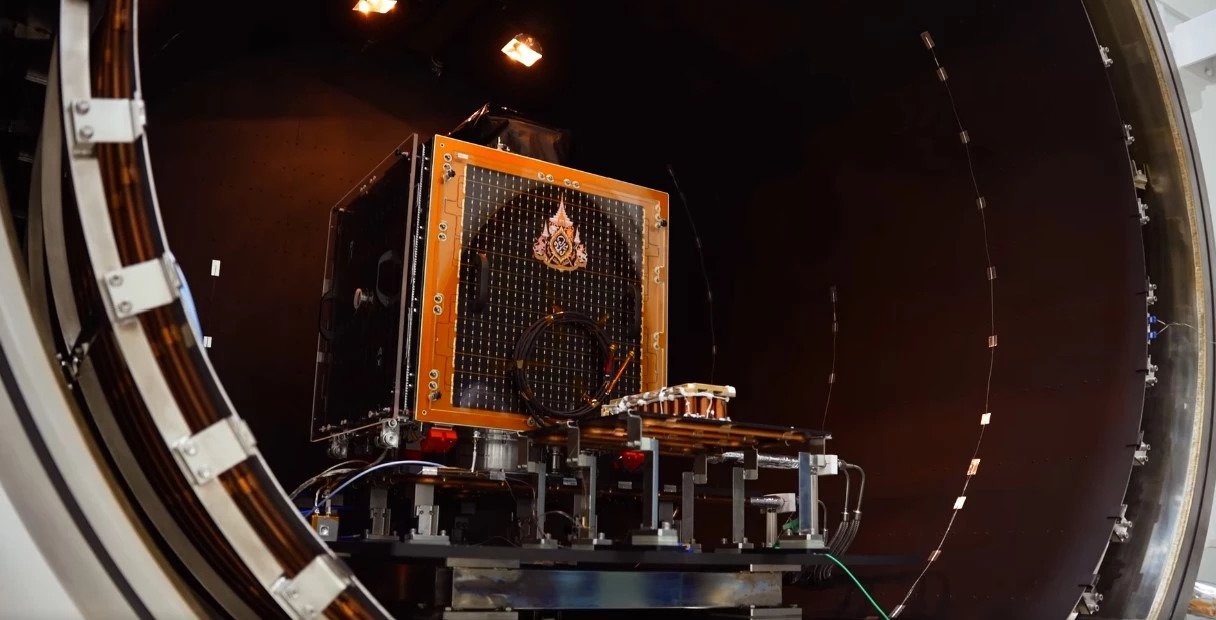

Recent debuts by artificial intelligence, semiconductor and robotics companies raised substantial capital and saw strong secondary trading, underscoring sustained interest in high-growth sectors.

Chinese equities more broadly have also benefited from targeted government support for tech development and a strategic focus on self-sufficiency in key industries, factors that analysts say could underpin continued outperformance relative to U.S. counterparts.

Leading investment strategists, including those at major global banks, point to comparatively stronger earnings growth projections for Chinese companies and expanding opportunities in emerging industries as reasons to maintain overweight positions in Asian equities.

Market dynamics such as attractive initial valuations, renewed retail participation and anticipated long-term expansion of China’s domestic markets further reinforce this view.

While risks remain, including geopolitical tensions and currency fluctuations, the combination of structural growth drivers and positive investor sentiment has shaped forecasts that Hong Kong and China stocks could see stronger relative returns than major U.S. indexes over the coming year.