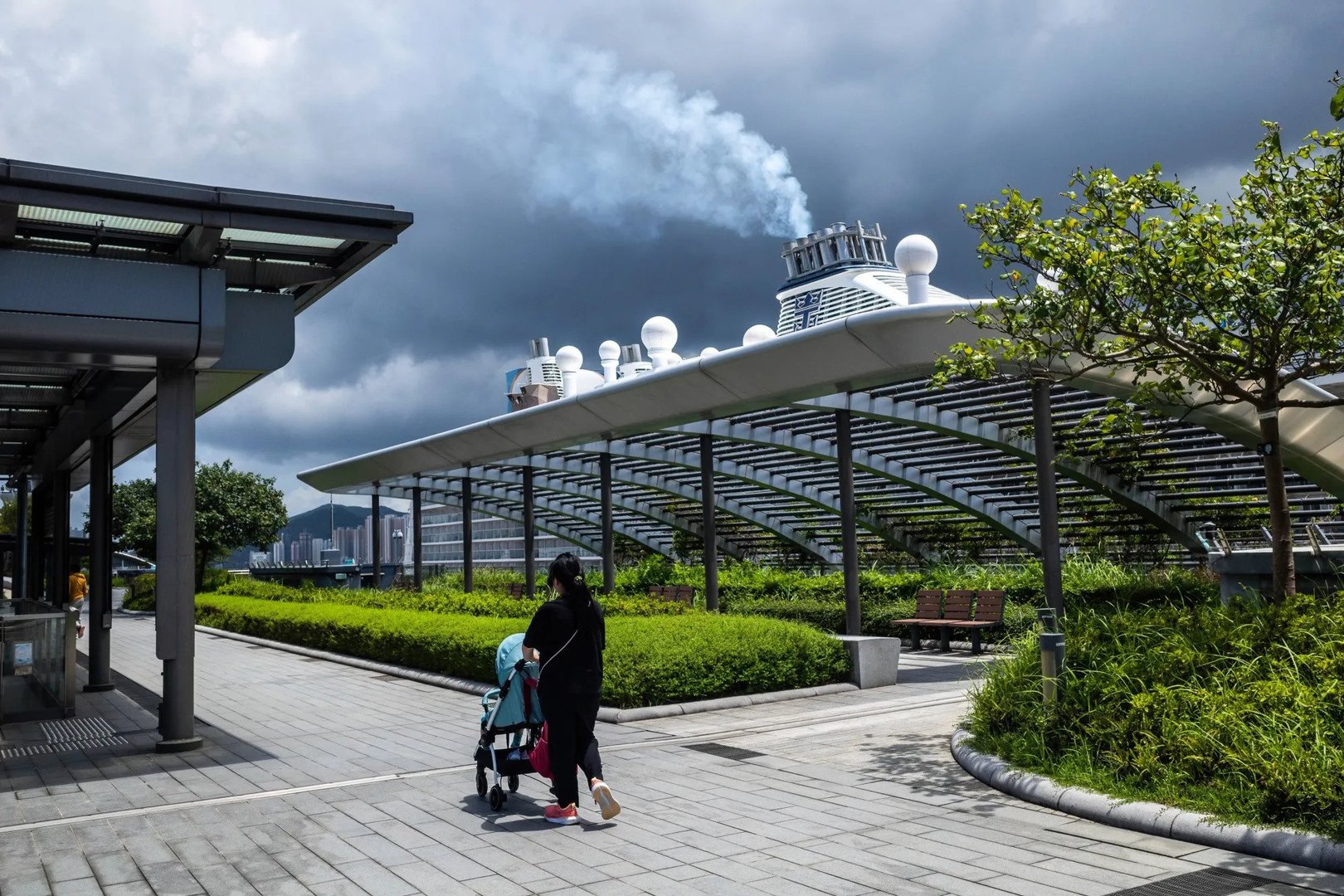

The rivalry comes as China’s population of overweight and obese adults expands rapidly, raising both commercial stakes and public health concerns.

The price reductions were triggered in December when Novo Nordisk halved the cost of its flagship weekly injection, Wegovy, in several provinces, prompting rivals to respond with steep discounts.

On major online platforms, the monthly cost of Eli Lilly’s Mounjaro has dropped to around 500 yuan for a common dose, down from nearly five times that level on launch — reflecting cuts of up to eighty per cent since its introduction.

These moves have been aimed at defending market share in one of the world’s fastest-growing weight-loss drug markets.

China’s domestic pharmaceutical sector is also stepping up its presence.

Local firms have accelerated the launch of homegrown glucagon-like peptide-1 (GLP-1)-based therapies and dual-target drugs, expanding options beyond the established Western brands.

Patent expiries, including that of semaglutide in March, are expected to further open the market to generics and lower-cost alternatives, reshaping competitive dynamics.

The price war comes amid alarming trends in public health: China’s number of overweight and obese adults could rise substantially in the next decades, according to health surveys, intensifying the urgency for effective interventions.

Analysts say that aggressive pricing by global pharmaceutical giants — willing to sacrifice margins to build volume — challenges local competitors to innovate and scale efficiently if they are to gain sustainable share.

Industry observers note that while lower prices expand access, they also compress profit margins and could complicate long-term investment in new drug development.

Nevertheless, the current market reshaping underscores China’s growing importance in the global GLP-1 and weight-management landscape, with implications for drug pricing, healthcare delivery and chronic disease management in the world’s most populous nation.