The developer, once viewed as relatively insulated from distress, has moved to defer loan and bond payments and is preparing a debt restructuring plan under government encouragement, signalling a delicate balancing act between avoiding outright default and managing broader sector risk.

Vanke agreed with several domestic lenders to defer interest payments on bank loans until September 2026, shifting from quarterly to annual payment terms to preserve liquidity and buy time for negotiations with bondholders on repayment extensions.

That arrangement, coordinated with support from the Shenzhen state asset regulator, followed a missed quarterly interest payment that had raised concerns about the firm’s near-term cash flow.

Despite these measures, efforts to extend onshore bond maturities have met resistance from creditors, and discussions are continuing on further repayment deadlines for upcoming maturities.

Bloomberg News reported that Vanke is drawing up a formal debt restructuring plan at the request of authorities, a step that would bring it closer to default territory even as officials seek to manage the process in an orderly way.

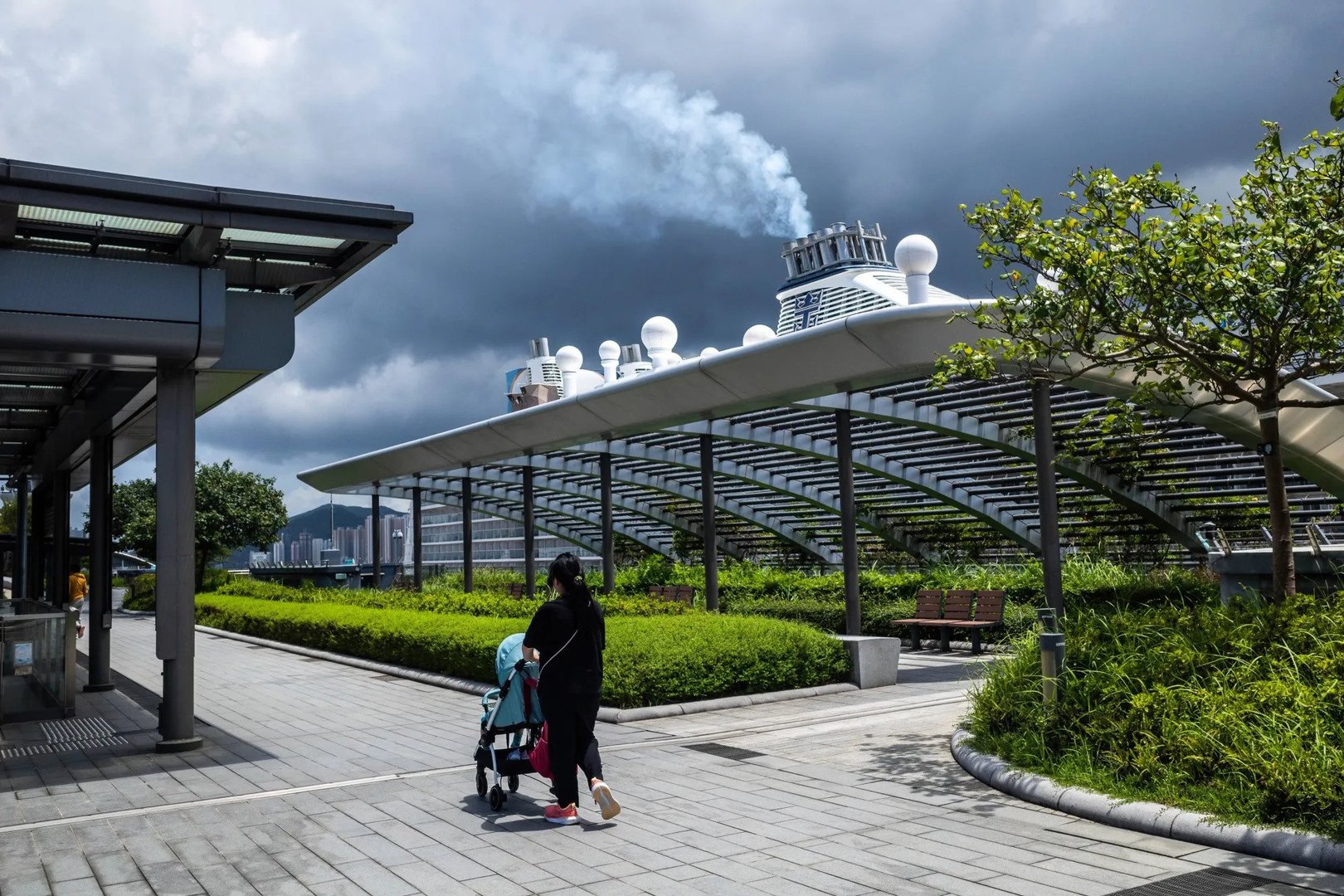

The company’s predicament reflects deep stresses in China’s property sector, where weak demand, falling prices and high leverage have prompted a string of defaults by major developers.

Vanke’s situation differs from earlier failures such as Evergrande because of its state links and proactive negotiations with banks.

Economists and credit strategists argue that while Vanke’s troubles may weigh on confidence and credit conditions, the concentrated nature of its exposure — and coordinated relief from lenders — reduces the likelihood of widespread financial contagion in China’s banking or bond markets.

Observers note that policymakers are focused on completing unfinished housing projects and containing fallout rather than broad systemic rescue operations.

Investors remain alert to developments, with Vanke’s share price and bond valuations sensitive to news on repayment talks and restructuring progress.

The coming weeks’ negotiation outcomes will test whether a managed restructuring can prevent an abrupt default and preserve broader market stability while addressing the company’s significant debt burdens.