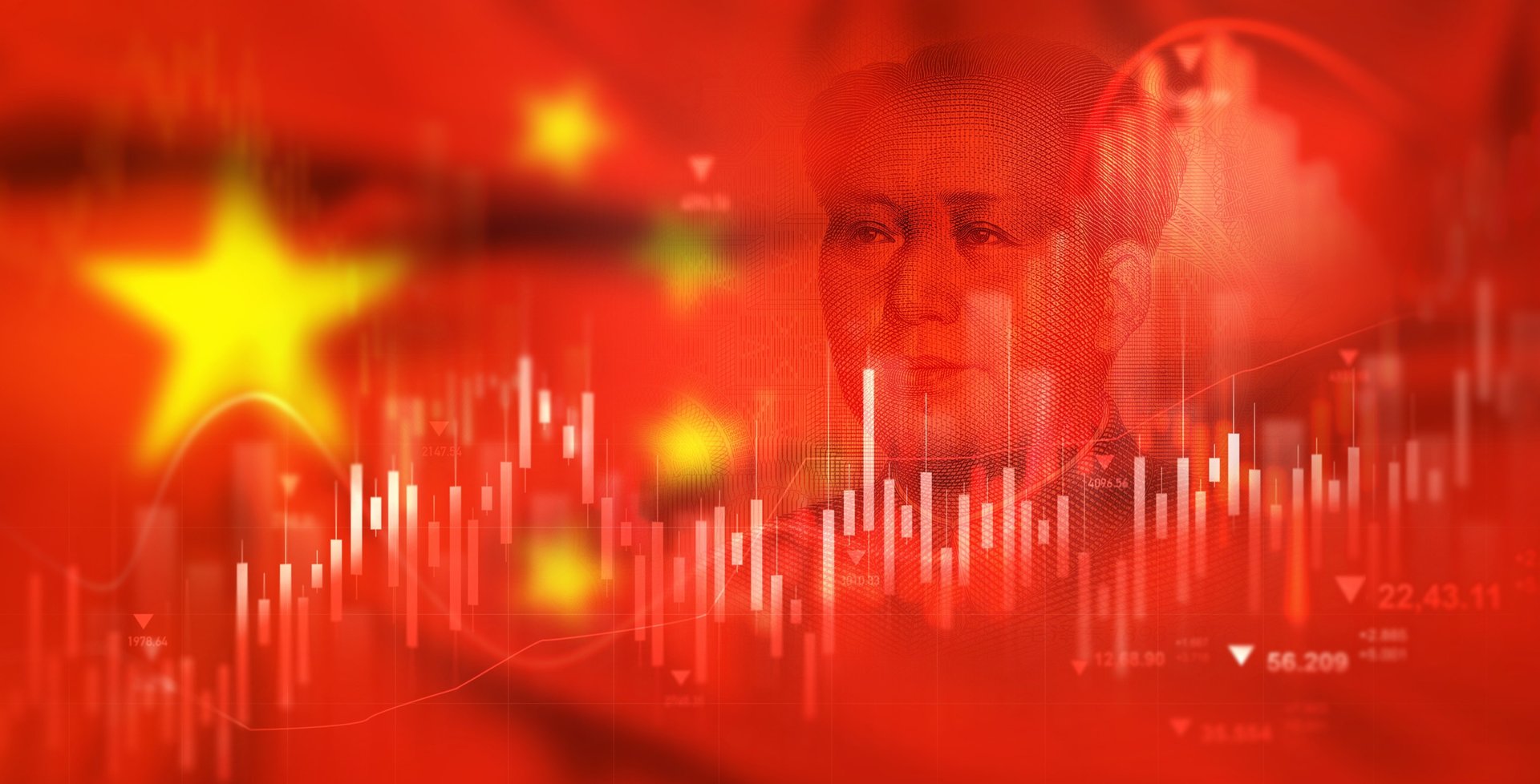

The benchmark index rose 0.6 per cent to around 27,170 in morning trading, building on the prior session’s 0.6 per cent increase to post its longest winning streak in roughly a year.

Market breadth was mixed, with the Hang Seng Tech Index marginally lower as some technology names lagged broader gains.

Sentiment in the city’s markets has been underpinned by relatively more attractive valuations compared with Wall Street, encouraging global investors to rotate toward Asian assets amid ongoing geopolitical uncertainty.

The Hang Seng’s advance this year has outpaced major US benchmarks, reflecting renewed confidence in regional growth prospects as well as supportive macro dynamics.

Mainland Chinese shares showed more modest moves, with the CSI 300 and Shanghai Composite indices easing slightly.

Among individual equities, several marquee names contributed to the uptrend.

Electric-vehicle maker BYD advanced notably, while logistics and property firms also posted solid gains.

Other large caps including e-commerce and pharmaceutical groups traded higher, lifting overall market sentiment.

Offsetting some of the optimism, select consumer and travel-related stocks weighed on performance after regulatory scrutiny in sectors such as online booking.

The sustained advance in Hong Kong equity prices reflects a broader pattern of Asian markets attracting interest as investors balance risk and return.

With the Hang Seng outperforming key international peers so far this year, market participants are watching closely for signals from macroeconomic data and policy developments that could influence the region’s trajectory.