Industry leaders highlight institutional adoption, regulatory clarity and regional innovation at flagship blockchain summit

Consensus Hong Kong 2026 concluded this week with a clear message: Asia is rapidly consolidating its position as a central force in the global digital asset ecosystem.

The multi-day summit brought together policymakers, institutional investors, technology executives and founders to assess the next phase of blockchain adoption, with a particular focus on regulatory coordination and capital flows across the region.

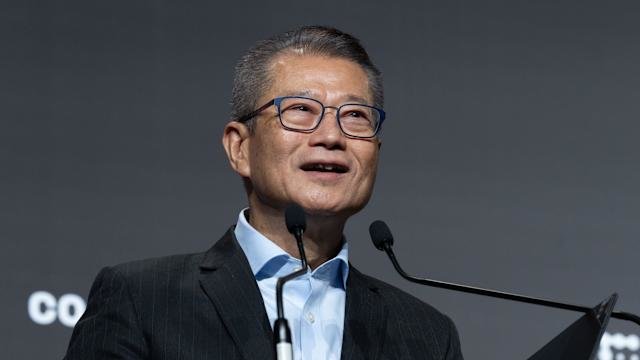

Hong Kong officials used the platform to reaffirm the city’s ambition to serve as a regulated gateway between mainland China and international crypto markets.

Speakers highlighted progress in licensing frameworks for virtual asset trading platforms, stablecoin oversight proposals and efforts to attract global Web3 firms.

Industry participants described the regulatory environment as increasingly predictable compared with the volatility seen in several Western jurisdictions over the past two years.

Institutional adoption was a dominant theme.

Asset managers and banking executives discussed growing allocations to tokenized securities, real-world asset platforms and exchange-traded products linked to digital currencies.

Panels underscored how tokenization of bonds and private credit instruments is accelerating, with several pilot programs already live across Asia.

Executives said the convergence of traditional finance and blockchain infrastructure is now less experimental and more operational.

Artificial intelligence integration with blockchain systems also featured prominently.

Developers presented new tools designed to automate compliance, enhance smart contract auditing and improve decentralized finance risk management.

Venture capital firms reported renewed funding momentum after a subdued period in 2024, noting that capital is returning selectively to projects demonstrating clear revenue models and regulatory alignment.

Market participants addressed volatility in digital asset prices, but discussions focused less on speculation and more on infrastructure resilience.

Exchange operators emphasized improved custody standards and cross-border settlement capabilities.

Meanwhile, regulators from multiple jurisdictions reiterated their intent to cooperate on anti-money laundering standards and investor protections while supporting responsible innovation.

The conference closed with cautious optimism.

Delegates broadly agreed that while global macroeconomic conditions remain uncertain, structural adoption of blockchain technology continues to deepen.

With Hong Kong positioning itself as a bridge between East and West, the event reinforced the city’s ambition to shape the next chapter of regulated digital finance.

The multi-day summit brought together policymakers, institutional investors, technology executives and founders to assess the next phase of blockchain adoption, with a particular focus on regulatory coordination and capital flows across the region.

Hong Kong officials used the platform to reaffirm the city’s ambition to serve as a regulated gateway between mainland China and international crypto markets.

Speakers highlighted progress in licensing frameworks for virtual asset trading platforms, stablecoin oversight proposals and efforts to attract global Web3 firms.

Industry participants described the regulatory environment as increasingly predictable compared with the volatility seen in several Western jurisdictions over the past two years.

Institutional adoption was a dominant theme.

Asset managers and banking executives discussed growing allocations to tokenized securities, real-world asset platforms and exchange-traded products linked to digital currencies.

Panels underscored how tokenization of bonds and private credit instruments is accelerating, with several pilot programs already live across Asia.

Executives said the convergence of traditional finance and blockchain infrastructure is now less experimental and more operational.

Artificial intelligence integration with blockchain systems also featured prominently.

Developers presented new tools designed to automate compliance, enhance smart contract auditing and improve decentralized finance risk management.

Venture capital firms reported renewed funding momentum after a subdued period in 2024, noting that capital is returning selectively to projects demonstrating clear revenue models and regulatory alignment.

Market participants addressed volatility in digital asset prices, but discussions focused less on speculation and more on infrastructure resilience.

Exchange operators emphasized improved custody standards and cross-border settlement capabilities.

Meanwhile, regulators from multiple jurisdictions reiterated their intent to cooperate on anti-money laundering standards and investor protections while supporting responsible innovation.

The conference closed with cautious optimism.

Delegates broadly agreed that while global macroeconomic conditions remain uncertain, structural adoption of blockchain technology continues to deepen.

With Hong Kong positioning itself as a bridge between East and West, the event reinforced the city’s ambition to shape the next chapter of regulated digital finance.