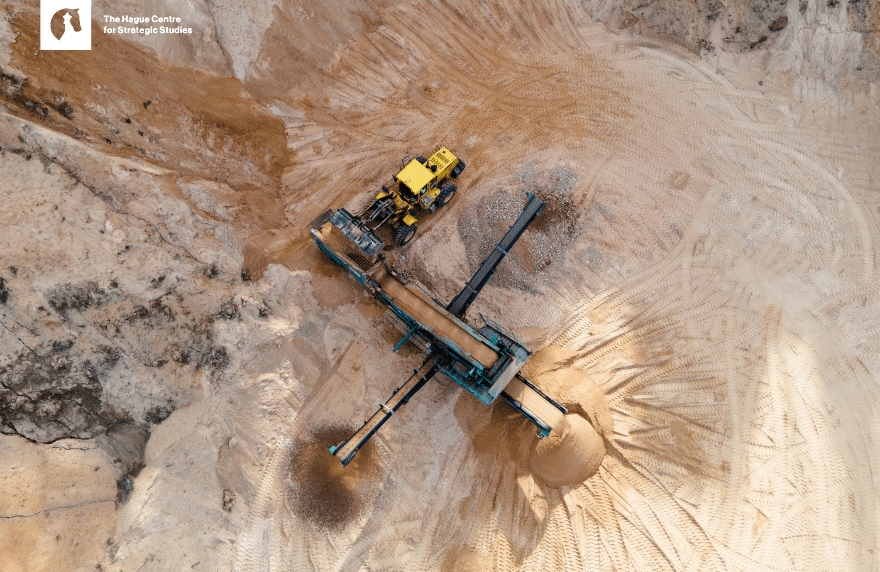

Vision 2030 investments in mining, processing and global partnerships reshape kingdom’s role in critical materials markets

Saudi Arabia is rapidly expanding its presence in global critical minerals markets, positioning mining and downstream processing as central pillars of its Vision 2030 economic transformation strategy.

The kingdom’s approach, built on large-scale state backing, international partnerships and infrastructure investment, is drawing attention in Europe as policymakers seek to secure supply chains for energy transition materials.

Riyadh has identified untapped mineral reserves—ranging from phosphate and bauxite to gold, copper and rare earth elements—as strategic national assets.

Government estimates suggest the value of these resources has risen substantially following updated geological surveys, reinforcing ambitions to transform mining into a major contributor to gross domestic product.

State-supported entities have expanded exploration licensing rounds and introduced incentives to attract foreign investment and technical expertise.

Beyond extraction, Saudi Arabia is investing heavily in refining and processing capacity to capture more value domestically.

New industrial zones and logistics corridors are being developed to integrate mining operations with manufacturing clusters, while sovereign-backed funds are pursuing stakes in overseas mining projects to diversify supply sources.

Officials have framed the strategy as a long-term play to embed the kingdom in global supply chains for batteries, electric vehicles and renewable energy infrastructure.

European governments, meanwhile, have intensified efforts to reduce reliance on concentrated suppliers of critical raw materials.

Recent regulatory initiatives aim to boost domestic extraction, recycling and strategic partnerships with resource-rich nations.

Analysts note that Saudi Arabia’s model—combining regulatory reform, capital deployment and diplomatic outreach—offers practical insights into how state coordination can accelerate sector development.

The kingdom’s annual mining conferences have become prominent platforms for international dealmaking, underscoring its ambition to serve as a bridge between resource markets in Africa, Asia and Europe.

With global demand for transition minerals expected to rise sharply in the coming decades, Saudi Arabia’s integrated strategy illustrates how resource policy can be aligned with industrial diversification and geopolitical positioning.

As Europe refines its own critical minerals framework, the Saudi experience highlights the importance of long-term planning, supply chain integration and coordinated investment in both upstream and downstream capabilities.

The kingdom’s approach, built on large-scale state backing, international partnerships and infrastructure investment, is drawing attention in Europe as policymakers seek to secure supply chains for energy transition materials.

Riyadh has identified untapped mineral reserves—ranging from phosphate and bauxite to gold, copper and rare earth elements—as strategic national assets.

Government estimates suggest the value of these resources has risen substantially following updated geological surveys, reinforcing ambitions to transform mining into a major contributor to gross domestic product.

State-supported entities have expanded exploration licensing rounds and introduced incentives to attract foreign investment and technical expertise.

Beyond extraction, Saudi Arabia is investing heavily in refining and processing capacity to capture more value domestically.

New industrial zones and logistics corridors are being developed to integrate mining operations with manufacturing clusters, while sovereign-backed funds are pursuing stakes in overseas mining projects to diversify supply sources.

Officials have framed the strategy as a long-term play to embed the kingdom in global supply chains for batteries, electric vehicles and renewable energy infrastructure.

European governments, meanwhile, have intensified efforts to reduce reliance on concentrated suppliers of critical raw materials.

Recent regulatory initiatives aim to boost domestic extraction, recycling and strategic partnerships with resource-rich nations.

Analysts note that Saudi Arabia’s model—combining regulatory reform, capital deployment and diplomatic outreach—offers practical insights into how state coordination can accelerate sector development.

The kingdom’s annual mining conferences have become prominent platforms for international dealmaking, underscoring its ambition to serve as a bridge between resource markets in Africa, Asia and Europe.

With global demand for transition minerals expected to rise sharply in the coming decades, Saudi Arabia’s integrated strategy illustrates how resource policy can be aligned with industrial diversification and geopolitical positioning.

As Europe refines its own critical minerals framework, the Saudi experience highlights the importance of long-term planning, supply chain integration and coordinated investment in both upstream and downstream capabilities.