The city’s stock exchange hosted thirteen new offerings in January, raising approximately five billion US dollars — the busiest start to a calendar year on record and a marked expansion of activity following robust fundraising in 2025.

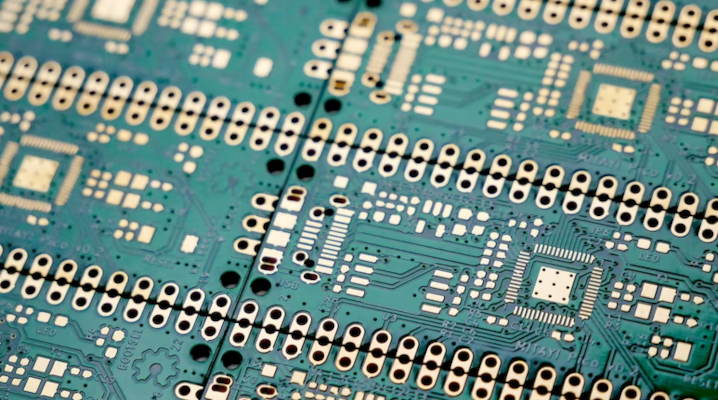

The surge in listings has been anchored by AI-related companies, including chip designers and large-language-model developers, reflecting Beijing’s strategic emphasis on technological self-reliance amid intensifying global competition in AI fields.

Investor interest in these offerings has been strong, buoyed by relatively attractive valuations in Hong Kong and optimism about the growth prospects of domestically developed technologies.

Market participants report that companies such as Shanghai Biren Technology and MiniMax Group — both of which focus on artificial intelligence hardware and software — have drawn significant attention, helping to fuel upbeat sentiment about the region’s capital markets.

Analysts suggest that the IPO pipeline remains substantial, with more than three hundred companies lining up to list and projections that total proceeds this year could reach levels not seen in the past six years.

China’s broader technology ecosystem, including firms planning listings such as AI chip unit Kunlunxin and generative AI developer Zhipu, further reinforces Hong Kong’s role as a premier venue for high-growth tech capital raising.

The city’s position as a gateway for Chinese firms seeking global investment has been bolstered by supportive regulatory frameworks and investor appetite for exposure to early-stage AI innovation.

While enthusiasm remains elevated, some market watchers note that regulators are monitoring deal quality and market dynamics to ensure sustainable growth.

Nonetheless, the early momentum positions Hong Kong’s equity capital markets at the forefront of the region’s financing landscape, with AI and technology offerings leading the resurgence in public market activity.