It's beginning to look a lot like 2016.

Former President Donald Trump is the only Republican so far who has announced a 2024 presidential run, but numerous others are signaling that they're toying with the same idea.

They're doing all the things they're supposed to do to test their chances: Visiting early primary states, writing books, showing up on the Sunday shows, campaigning with other Republicans ahead of the 2022 midterms, and weighing in publicly on President Joe Biden's policies — and even Trump's latest controversies.

The next step will be hiring teams in Iowa and New Hampshire, Doug Heye, a longtime GOP aide and strategist, told Insider.

"You have got a stable of people who are essentially putting themselves all in the starting gates and all have their own timetable about when and if they decide to run," he said.

December would be a "frustrating month" for political watchers because "no one is going to move that much," said Kristin Davison, vice president and general consultant at Axiom Strategies. But hopefuls would be floating what she called "trial balloons" — in which they publicly raise the prospect of a run to see how donors and the press will react.

Whoever seizes the nomination will likely face Biden, though he has yet to formally declare his candidacy. But, Heye said, "it's a real possibility" that the GOP lineup will be large like it was in 2016.

The stakes for losing the nomination aren't all bad, even if Republicans might come out of it with an unforgettable Trump nickname. After all, one of the people running for president could end up getting chosen as running mate or get a seat on the new president's Cabinet.

And there are other perks to formally seeking the White House, such as raising one's profile and having a better shot at the presidency during a future cycle. Candidates could also wind up selling a lot more books or leave politics to get a prime TV or radio show.

"It's a long, difficult process," Heye said, "and you're more likely to lose than not."

Trump's legal, political, and personal liabilities have been piling up in the last month, leading many in the GOP to say the party needs not just a fresh face but to be led by a candidate who can actually win.

Insider identified 17 people who could seek the Republican nomination in 2024, including Sens. Ted Cruz of Texas, Josh Hawley of Missouri, and Tim Scott of South Carolina who are up for re-election this cycle and will therefore be in campaign mode anyway. Each will have to effectively answer the "why I'm running for president" question and find their lane in the party — which will inevitably include defining, or redefining, their relationship with Trump.

"I don't think you can discount any of them at this point," Heye said. "It's too early to determine who outside of Trump is a frontrunner."

Scroll through to see the lawmakers listed here in alphabetical order.

Outgoing Rep. Liz Cheney of Wyoming

Rep. Liz Cheney, a Republican of

Wyoming, campaigned with Rep. Elissa Slotkin, a Democrat of Michigan, at

an Evening for Patriotism and Bipartisanship event on November 1, 2022

in East Lansing, Michigan.

Rep. Liz Cheney, a Republican of

Wyoming, campaigned with Rep. Elissa Slotkin, a Democrat of Michigan, at

an Evening for Patriotism and Bipartisanship event on November 1, 2022

in East Lansing, Michigan.

Cheney, 56, is the daughter of former Vice President Dick Cheney and one of Trump's toughest Republican critics.

She voted to impeach Trump after the January 6, 2021, attack on the US Capitol, and served as vice chair of the House select committee investigating Trump's efforts to overturn the 2020 election.

Cheney's actions have come at a cost under the heavy weight of Trump's ire. House Republicans punished her by stripping her of her leadership post, and she lost her US House seat to Trump-backed GOP challenger Harriet Hageman during the state's August primary.

But she hasn't been deterred. Cheney said on NBC's "Today" that she would do "whatever it takes" to keep Trump out of the White House in 2024, including "thinking about" running for president herself. "I wouldn't be surprised to see her run for president," Republican Sen. Mitt Romney of Utah told Insider in August.

Cheney voted with Trump on policy when he was in office, and remains a conservative, telling the Reagan Foundation and Institute in June that she believes "deeply in the policies of limited government, of low taxes, of a strong national defense."

But Cheney said she sees a breaking point with the Republican Party, telling the Texas Tribune Festival in September that she would leave the GOP if Trump became the 2024 nominee.

This could mean she'd run for president as an Independent. Already, she has shown she's willing to campaign against Republicans who falsely deny that Biden won the 2020 presidential election.

This year, Cheney converted her House campaign finance committee into an anti-election denier leadership PAC called The Great Task. The PAC spent $500,000 on a TV ad in Arizona that urged voters to reject Republicans Kari Lake and Mark Finchem, who were running for governor and secretary of state, respectively.

During the 2022 midterms, Cheney endorsed incumbent Democratic Reps. Elissa Slotkin of Michigan and Abigail Spanberger of Virginia. Both won their races.

"We had to make sure that we prevented election deniers from taking power," she told The Washington Post's Global Women's Summit in November.

Many outsiders see long odds for Cheney, though a poll conducted in Utah found she could be a top contender there.

Outgoing Rep. Adam Kinzinger of Illinois

Like Cheney, Kinzinger, 44, has spent much of the last year focused on the January 6 committee and drawing Trump's ire. He's the only other Republican on the House committee investigating the riot, and will be retiring from his seat at the end of this Congress, after six terms.

Kinzinger told HuffPost in April that he "would love" to run against Trump for the 2024 GOP nomination, but more for the fun of it than to actually win.

"Even if he crushed me, like in a primary, to be able to stand up and call out the garbage is just a necessary thing, regardless of who it is," he said. "I think it'd be fun."

In a move that could be signaling he's planning on doing just that, Kinzinger in early 2021 launched his anti-election denier leadership PAC, called Country First.

Kinzinger sponsored several bills that became law, including measures to prevent opioid addiction and a bill to help veterans with medic training transition to EMT work as civilians. Kinzinger served in the Air Force and remains a pilot in the Air National Guard.

Sen. Ted Cruz of Texas

Sen. Ted Cruz, a Republican of

Texas, speaks at a rally for Republican Senate candidate Herschel Walker

on November 10, 2022 in Canton, Georgia.

Sen. Ted Cruz, a Republican of

Texas, speaks at a rally for Republican Senate candidate Herschel Walker

on November 10, 2022 in Canton, Georgia.

Cruz, 51, was the last Republican standing against Trump during the 2016 presidential nomination and had even announced that he'd pick former Hewlett-Packard CEO Carly Fiorina as his running mate.

But Cruz — whom Trump nicknamed "Lyin' Ted" — lost following a nasty primary in which Trump levied highly personal attacks against the senator, including disparaging his wife's looks and falsely suggesting that Cruz's father had something to do with the assassination of President John F. Kennedy.

Once Trump was in office, however, Cruz was one of the president's biggest defenders. He voted to overturn the 2020 election results in Arizona and Pennsylvania and helped to secure Trump's acquittal in his second impeachment trial.

In recent months, Cruz has been spending time in New Hampshire and campaigned with retired football star Herschel Walker in the Georgia Senate runoff.

While in the Senate, Cruz led the successful effort to zero out the unpopular fine on the uninsured created by the Affordable Care Act.

More recently, Cruz used Ketanji Brown Jackson's Supreme Court confirmation hearing to score points for a potential 2024 run, questioning her about school curriculum on race. Before coming to Congress, Cruz was solicitor general in Texas, a role that involves arguing cases before the Supreme Court.

When Insider asked whether Trump's latest missteps had provided an opening for him to jump into the 2024 presidential race, Cruz chuckled a bit before laying out what sounded like a near-term agenda.

"I think the Senate is the battleground … and I'm going to do everything I can to lead the fight right here," Cruz told Insider before launching into a tirade about his mounting frustration with Senate Minority Leader Mitch McConnell's decision making. He made no specific mention of 2024, but also didn't work in the word "no" anywhere.

Cruz told the Republican Jewish Coalition in Las Vegas that he'll seek reelection in Texas in 2024 when his term is up, though state law allows him to run for both offices at the same time.

Former Gov. Chris Christie of New Jersey

Christie, 60, is famously said to have missed his moment for the White House because he didn't run for president when he was getting a lot of attention as New Jersey's governor in 2012, and instead fizzled out in 2016 when faced with Trump and numerous other contenders.

But that hasn't stopped him from weighing another go at it. As recently as October, during an appearance on "Real Time with Bill Maher," Christie confirmed that he was considering a 2024 run.

In the last 18 months, Christie has been prominently involved in midterm campaigning and on the same speech circuit as other GOP hopefuls, including the Ronald Reagan Library in Simi Valley, California.

He also put out a book in 2021, titled "Republican Rescue: Saving the Party From Truth Deniers, Conspiracy Theorists, and the Dangerous Policies of Joe Biden."

Christie served two terms as a Republican governor in a blue state where Democrats controlled the legislature. In that role, he expanded Medicaid under Obamacare and passed bail reform.

But he got flak over a handshake with then-President Barack Obama during Hurricane Sandy relief efforts, and was hurt politically after members of his administration created traffic jams on the George Washington Bridge.

Christie became a lobbyist in 2020, when he had several healthcare clients but cut ties a year later, according to the lobbying disclosure database, in what could be a sign that he's lining up for a run.

Today, Christie blames Trump for the GOP's losses the last three election cycles and spent months saying Republicans "have to be the party of tomorrow, not the party of yesterday" if they ever want to win another election.

His tone on Trump is a stunning turnaround for a man who was one of Trump's closest outside advisors when he was in the White House and was even on the shortlist to be Trump's chief of staff.

Christie turned on Trump after January 6, saying the president violated his oath of office.

More recently, he told The New York Times that Trump's candidacy was "untenable" and that the former president had had "poor judgement" after he dined at Mar-a-Lago with white supremacist and Holocaust denier Nick Fuentes. He also told the Washington Examiner that Republicans "fail the leadership test" when they don't call out Trump.

Gov. Ron DeSantis of Florida

Republican gubernatorial candidate

for Florida Ron DeSantis speaks during an election night watch party at

the Convention Center in Tampa, Florida, on November 8, 2022.

Republican gubernatorial candidate

for Florida Ron DeSantis speaks during an election night watch party at

the Convention Center in Tampa, Florida, on November 8, 2022.

DeSantis, 44, has an enviable mantle for the presidency in the Florida governor's office — and he's making the most of it.

He famously and unapologetically reopened Florida during the COVID-19 pandemic, before federal health officials said he should. He banned certain teachings on race in workplaces and schools, and flew unsuspecting migrants from Texas to Martha's Vineyard, Massachusetts.

DeSantis also signed a contentious parental involvement and sex ed bill into law that critics call "Don't Say Gay." Instead of backing down over the outcry, he punished Disney for threatening to repeal it.

Then there were the historic tax cuts in Florida with promises of more as well as viral videos bashing what he calls the "corporate media."

All of these actions have portrayed the governor as a fighter.

That's not the only part of his public persona on display. Often in tow is his beautiful, young family. His former newscaster wife, Florida's first lady Casey DeSantis, has been instrumental in his rise. To the New York Post, pictures of the DeSantis family on Election Night was "DeFuture." Others see a conservative JFK.

But the politician DeSantis most often gets compared to is Trump. Numerous news profiles have described DeSantis as "Trump without the baggage," or as a more disciplined Trump.

Yet after leaning on Trump during his first gubernatorial victory in 2018, DeSantis showed he could win big on his own, scoring a historic, 20-point victory in Florida in November without Trump's endorsement.

As for presidential clues, DeSantis is also out with his first memoir in February: "The Courage to Be Free: Florida's Blueprint for America's Revival." During the midterms, he extended goodwill to other Republicans by campaigning with them. Back at home, he raked in a record amount of cash for a gubernatorial race.

If the GOP primary were decided today, numerous polls show, DeSantis is the only person that gets close to Trump. DeSantis, a former conservative House member, has not pledged to serve out all four years of his second term.

All of that has angered Trump. He has called DeSantis "Ron DeSanctimonious" and threatened to release damaging information about the governor.

DeSantis has refused to punch back at Trump publicly, instead blaming the media and saying, "When you're leading, when you're getting things done, you take incoming fire."

South Dakota Gov. Kristi Noem

South Dakota Gov. Kristi Noem speaks during the Conservative Political Action Conference in Dallas, Texas, on July 11, 2021.

South Dakota Gov. Kristi Noem speaks during the Conservative Political Action Conference in Dallas, Texas, on July 11, 2021.

Noem, 51, has been on a Trump-related roller coaster ride as of late.

In January 2021, the embattled former president tried to get her to primary fellow South Dakota Sen. John Thune, a lawmaker Trump took to calling a RINO (which stands for "Republican in name only") after Thune balked at his baseless claims of election fraud. Noem bowed out of joining Trump's revenge campaign, opting to focus on her own re-election plans.

Once 2022 rolled around, she leaned hard into the GOP culture wars, promising voters that she'd bar transgender athletes from participating in women's sports, stamp out any "critical race theory" instruction in local schools, and decimate any "radical political ideologies" that annoyed her evangelical Christian base.

Come July, Noem told CNN she'd be "shocked" if Trump tapped her to be his 2024 running mate. But she didn't rule out sliding into the VP slot — or mounting a challenge of her own.

Since winning a second term in November, Noem has started taking on bigger foes, including the People's Republic of China.

Her state government-wide ban against the use of social media app TikTok scored her fawning interviews on conservative outlets including Fox News and Newsmax, beaming her into the homes of potential admirers who don't happen to reside in the Mount Rushmore State.

Noem seems far less enthusiastic about Trump these days, telling reporters that the twice-impeached, scandal-plagued former president isn't Republicans' "best chance" at retaking the White House in 2024. She issued this prediction just days after Trump announced he was running again.

Former UN Ambassador Nikki Haley

Haley, 50, has made it clear she's interested in the presidency.

At the Republican Jewish Coalition in November, she told the crowd she was thinking about a presidential run "in a serious way" and would announce a decision "soon."

"I've won tough primaries and tough general elections," she said. "I've been the underdog every single time. When people underestimate me, it's always fun. But I've never lost an election. And I'm not going to start now."

The remarks were a turnaround from Haley's comments last year, when she said she wouldn't run for president if Trump were to seek the White House in 2024. Haley said at a Turning Point USA event that she'd take the winter holidays to make a decision.

Early in her career, Haley joined her family's clothing business before leading the National Association of Women Business Owners.

She served in the South Carolina House for three terms then was the state's governor for six years. In that time Haley delivered the GOP response to Obama's 2016 State of the Union Address.

She pushed for the removal of the confederate flag from the South Carolina capitol after a gunman killed nine Black people at Emanuel Church in Charleston.

Also as governor, Haley would not support a bill requiring transgender people to use the restroom that corresponded with the gender on their birth certificate. But in 2021 she wrote a commentary in the National Review saying transgender inclusion in sports was an "attack on women's rights."

Haley was UN Ambassador under Trump for two years, and successfully pushed for the US to move its Israeli embassy to Jerusalem and defended Trump's decision to do so.

In 2019 she published a memoir, "With All Due Respect: Defending America with Grit and Grace."

Her experiences give her the coveted pairing of having both executive and foreign policy chops, which are often viewed as crucial to the presidency. Aside from Trump and Pence, few other contenders would have such a profile.

As a woman of Indian descent, she could also help bring in suburban women voters who graduated from college and expand the GOP coalition among people of color.

Her nonprofit group, called Stand for America, Inc., is seen as a campaign in waiting and raised about $8.6 million in 2021, according to Politico. And she founded the Stand for America PAC after her time in the Trump administration.

Haley campaigned and fundraised in high-profile races during the 2022 midterms, including in Pennsylvania and Georgia. Haley told the National Republican Committee the day after the January 6 riot that Trump was "badly wrong" in his speech to supporters and that his "actions since Election Day will be judged harshly by history."

Sen. Josh Hawley of Missouri

Senator Josh Hawley (R-MO) speaks during the confirmation hearing for Judge Ketanji Brown Jackson on March 22, 2022

Senator Josh Hawley (R-MO) speaks during the confirmation hearing for Judge Ketanji Brown Jackson on March 22, 2022

Hawley, 42, has reached for the spotlight whenever possible while Congress is in session.

From famously saluting the January 6 protestors on the day of the violent siege at the Capitol to holding Brown Jackson's feet to the fire as she raced to join the Supreme Court, the first-term lawmaker works to portray himself as the perennial outsider who's only here to shake things up.

He's played up the part by voting to overturn the 2020 election results on behalf of MAGA vote-magnet Trump, butting heads with McConnell on the way the upper chamber is run, and blaming short-sighted leaders for running the party into the ground.

"When your 'agenda' is cave to Big Pharma on insulin, cave to Schumer on gun control & Green New Deal ('infrastructure'), and tease changes to Social Security and Medicare, you lose," Hawley, bemoaned on Twitter following a demoralizing midterms performance by flawed GOP candidates, which he blamed on "Washington Republicanism."

The potential 2024 contender followed up with some suggestions, floating an alternative vision he said would help "unrig the system."

"What are Republicans actually going to do for working people? How about, to start: tougher tariffs on China, reshore American jobs, open up American energy full throttle, 100k new cops on the street," Hawley, who was also Missouri's former attorney general, tossed out on his social media feed.

Asked by Insider about his intentions of formally jumping into the 2024 presidential race, Hawley laughed out loud for a few seconds.

"I hope to run for reelection to the Senate in 2024. If the people of Missouri will have me," he said. Nowhere in there did Hawley say "no."

Outgoing Gov. Larry Hogan of Maryland

Even before the bruising 2022 midterms, Hogan, 66, was warning that

Republicans couldn't continue down the path they are on.

"I am not about to give up on the Republican party or America," he wrote on Twitter in early December. "None of us can. It's too important."

The two-term governor who beat a 2015 cancer scare has been fired up about plotting his next act.

Hogan, a centrist Republican, is already making the rounds in early primary states such as Iowa and New Hampshire. A nonprofit group aligned with him reported raising $2 million in 2021, some of which was spent on "supporter acquisition" and "audience building."

And Hogan recently scored some face time with GOP mega donors at this year's Republican Jewish Coalition leadership meeting — mentioning to political reporters covering the event that he and other potential 2024 hopefuls were there because "maybe there's a little blood in the water." Trump was notably absent at the event, but did video-conference in.

As governor, Hogan signed a gun control bill into law and has said that while he opposed abortion, he wouldn't move to gut the state's guarantee on reproductive rights. During the COVID-19 pandemic he instituted a statewide mask mandate, then lifted restrictions in May 2021.

While he has yet to formally declare a 2024 run, Hogan has begun billing himself as a "commonsense conservative" who GOP voters sick of losing may want to consider.

"I think there are 10 people who want to be the next Donald Trump, and I think there may be a different lane," Hogan said while stumping in Manchester, New Hampshire, adding, "I'm going to do everything I can to get the country back on track."

He cast a write-in vote for Reagan in the 2020 election and called for Trump to be impeached or resign after January 6.

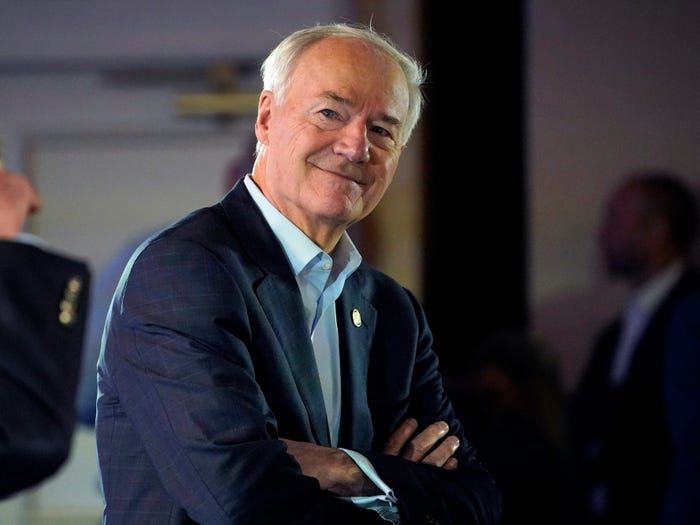

Outgoing Gov. Asa Hutchinson of Arkansas

Arkansas Gov. Asa Hutchinson attends

the National Governors Association summer meeting, Friday, July 15,

2022, in Portland, Maine.

Arkansas Gov. Asa Hutchinson attends

the National Governors Association summer meeting, Friday, July 15,

2022, in Portland, Maine.

Hutchinson, 72, hasn't been shy about criticizing Biden or Trump.

After Trump's 2024 announcement, he said the former president's "self-indulging message promoting anger has not changed," and also disavowed the Fuentes and Ye meeting at Mar-a-Lago.

Hutchinson has taken at least five trips to Iowa through America Strong & Free, the nonprofit of which he's the honorary chairman and spokesperson.

"I am seriously looking at a run in 2024 because America and the Republican Party are not in the best place," he said in a statement provided to Insider. "I know how to get us back on track both in terms of leadership and facing the challenging issues of border security, increased violent crime and energy inflation."

He'll make a decision in January, he told KARK.

As governor for the last eight years, he has pushed to make the state a leader in computer science, and signed several tax cuts into law, including lowering the state income tax rate from 7% to 4.9%.

Hutchinson also signed bills into law blocking businesses from requiring customers and workers to show proof of COVID-19 vaccinations, and blocked state and local officials from obligating masks — a move he later said he regretted. He asked state lawmakers to create a carve-out for schools, but the Arkansas House rejected the proposal.

While he signed an abortion ban into law in 2019 that took effect after the Supreme Court overturned Roe v. Wade, he said on CNN that he personally believes in exceptions for rape and incest.

"Many out there appreciate a 'consistent conservative,' even one they don't agree with all the time," Hutchinson told Insider. "I am not interested in the 'outrage of the day,' and I am committed to using my consistent conservative principles to guide me and our nation on important policy decisions."

Hutchinson began his government career as a US attorney for the Western District of Arkansas under President Ronald Reagan, then went on to serve in the US House for three terms. President George W. Bush tapped him to lead the Drug Enforcement Administration, after which he served as undersecretary in the Department of Homeland Security.

He has criticized Biden on illegal immigration, inflation, student loan forgiveness, and said on CNN that the president's September speech about democracy "singled out a segment of Americans and said basically they're our enemy."

Hutchinson also has the distinction of being especially press friendly at a time when numerous Republicans have copied Trump's style of lashing out against journalists.

"The media plays an important role in our democracy," Hutchinson told Insider. "I've never shied away from tough questions, and I have always been willing to defend my positions and conservative principles with the hard questions coming from the press."

Former Vice President Mike Pence

Pence, 63, has begun to distance himself from his former boss, while also promoting his new book, "So Help Me God."

He told ABC's "World News Tonight" that Trump "decided to be part of the problem" by not immediately calling off the insurrectionists during the January 6 riot, after he declined to help invalidate Biden's lawful win.

Pence also pushed back against Trump on WVOC in South Carolina after he called for terminating the Constitution, and came out forcefully after Trump had dinner with Fuentes.

"President Trump was wrong to give a white nationalist, an anti-Semite, and a Holocaust denier a seat at the table," he said on November 28.

An adviser to the former vice president told Insider that, should Pence decide to run, the team has discussed several policy areas to differentiate himself, including Trump's bipartisan criminal justice reform bill, the First Step Act, and that he'll continue to be "very outspoken on the issue of life."

In contrast, Trump didn't mention his three Supreme Court picks when he announced his 2024 presidential run, even though they helped overturn the landmark Roe v. Wade decision that previously guaranteed a national right to abortion.

Pence wouldn't have to worry about name ID during a presidential run. Still, his new book and a campaign would allow him to reintroduce himself to voters by talking about his work in the US House and then as governor of Indiana. He already has made numerous trips to early primary states New Hampshire and South Carolina.

Further, he'll be able to amplify policies that carried his fingerprints during the Trump administration, including his oversight of the US's pandemic response.

Pence was a sought-after midterm surrogate, traveling to dozens of states. In May, he went to Georgia to help incumbent Gov. Brian Kemp beat Trump-backed primary challenger David Perdue.

Pence's vision for the future of the party is laid out in his Freedom Agenda and Advancing American Freedom, the nonprofit aligned with him that serves as a type of campaign in waiting. The policies include reducing mail-in voting and implementing universal school choice, which allows public education funds to pay for K-12 students to select alternatives to public schools.

While Pence didn't testify before the January 6 select committee, his senior aides including former chief of staff Marc Short and legal advisor J. Michael Luttig walked investigators through some of the scenarios that led up to the attack.

In November, Pence said on Fox's "Hannity" that he would make a 2024 decision after discussing it with his family during the holidays.

Former Secretary of State Mike Pompeo

Former Secretary of State Mike

Pompeo speaks at the annual leadership meeting of the Republican Jewish

Coalition, Friday, November 18, 2022, in Las Vegas.

Former Secretary of State Mike

Pompeo speaks at the annual leadership meeting of the Republican Jewish

Coalition, Friday, November 18, 2022, in Las Vegas.

Pompeo, 58, told Chicago donors in September that he already had teams in Iowa, New Hampshire, and South Carolina.

His outside campaign in waiting is called Champion American Values Fund, and Pompeo has been doing press appearances to talk about his forthcoming book, "Never Give an Inch: Fighting for the America I Love."

Pompeo represented Kansas in the US Congress and was also former CIA director under Trump. After the end of the administration, he lost weight, which sparked speculation that he was interested in a White House run.

Similar to Haley, Pompeo would enter the contest with a foreign policy background.

He has openly criticized Biden, including after the president's September speech on protecting democracy. "He essentially said if you're pro-life or you're opposed to a certain set of policies, you're a threat," Pompeo told the New England Council's "Politics and Eggs" breakfast.

Biden, he said at the event, could be summed up as having "woke ideas, weak resolve, and waffling leadership."

Trump should not have taken classified documents to Mar-a-Lago, he said, but added that the "raid on Mar-a-Lago was indecent and improper."

Pompeo told conservative radio talk show host Hugh Hewitt in November that Trump's announcement wouldn't affect whether he decides to run for president, adding that he'd make a determination in the spring.

"We need more seriousness, less noise, and leaders who are looking forward," Pompeo said, "not staring in the rearview mirror claiming victimhood."

Sen. Marco Rubio of Florida

Rubio, 51, has come out hot after cruising to a third term in November, castigating GOP leaders for totally blowing the midterms.

"We have a historically unpopular Dem President, record inflation, a violent crime wave & total chaos at the border & not only did we fail to win a majority, we lost a seat. And the Senate GOP response is going to be to make no changes?" Rubio fumed in a December 7 Twitter post.

His anger hadn't abated when Insider caught up with him at the US Capitol.

"I don't know how you come back from what we have just encountered and conclude that the status quo and business as usual is how we want to proceed," Rubio said of the need for drastic changes within the GOP.

While conceding that he doesn't have "all those answers," Rubio suggested that Senate Republicans take a hard look at "the mechanics of elections, policy, the legislative agenda, and all of that."

"I think that's something we should all be involved in talking about," Rubio said of the sorely needed soul searching.

Rubio, who is of Cuban descent, was speaker of the Florida House before heading to Washington. He has sponsored numerous bills that have become law, including doubling the child tax credit and co-authoring the Paycheck Protection Program that helped keep small businesses afloat during the COVID-19 pandemic.

On top of that, he's got a powerful perch as the top Republican on the Intelligence Committee. Political operatives have credited him with helping the GOP grow its influence with Hispanic voters, NBC News reported.

Asked by Insider whether he had it in him to take another run at the former president after getting clobbered by the insult-flinging Trump in 2016, Rubio said he just really needs to take a breath.

"We'll have time over the holidays and into the new year to sort of focus on everything going on in my life and here in the Senate," Rubio told Insider, adding that he hasn't "really focused in on" returning to the presidential proving grounds at the moment.

Perhaps voters will learn more about future plans in his forthcoming book, "Decades of Decadence."

Sen. Tim Scott of South Carolina

Scott, 57, hinted at a presidential bid during his midterms victory speech, even though he previously said he wouldn't run against Trump.

"My grandfather voted for the first man of color to be elected as president of the United States," he said on November 8, referring to the vote his grandfather cast for Obama. "I wish he had lived long enough to see perhaps another man of color elected president of the United States. But this time, let it be a Republican and not just a Democrat. So just know: All things are possible in America."

Scott, who previously served in the US House, is the only Black Republican in the Senate. He said his six-year term in the Senate beginning in January will be his last, but he hasn't ruled out a presidential run and is making all the right moves to position himself for the undertaking.

Despite his own election, he has taken several trips to Iowa and spent time campaigning on behalf of other Republicans. He also released a memoir, "America, a Redemption Story: Choosing Hope, Creating Unity" and is one of the top fundraisers in the Senate — which includes support from small and online donors — even though he defended a safe seat this cycle.

Major donors have contributed to Opportunity Matters Fun, a pro-Scott super PAC.

Scott was among those leading the push for the successful passage of the bipartisan First Step Act and his measure to create Opportunity Zones that bring private investments into economically distressed communities was part of the 2017 tax reform law.

He garnered national interest after delivering the GOP response to Biden's address to Congress in April. Afterward, McConnell said the senator represented "the future of the Republican Party."

Scott has been open about the racism he has faced over the course of his life. "I get called Uncle Tom and the n-word by progressives, by liberals," he said in response to Biden's address. He has shared that police have pulled him over numerous times, despite him not violating any traffic laws. He sat down with Trump at the White House to discuss systemic racism and publicly called on Trump to call back certain statements he made on race.

Haley, who was South Carolina governor at the time, appointed Scott to the Senate in 2013 after the seat opened up.

Miami Mayor Francis Suarez

Suarez, 45, confirmed in October that he's considering a presidential run.

"It's something that I would consider given the right circumstances and given the right mood of the country," Suarez said at a Punchbowl News event.

Miami has been getting a lot of attention given the surge of people moving to Florida — and tech companies and crypto startups in particular headed to Miami under Suarez's encouragement. He even told Twitter CEO Elon Musk that he should consider relocating the company's headquarters from San Francisco.

Suarez's office sent over a list of accomplishments for the mayor, saying the city was No. 1 in job and wage growth, and had 1.4% unemployment. The Financial Times called Miami "the most important city in America."

The mayor made historic increases to the city's police department, increased funding on climate-resistant infrastructure, and passed a rental tax credit for seniors.

Suarez didn't vote for Trump during the 2020 election and in the 2018 gubernatorial race in Florida he voted for Democrat Andrew Gillum over DeSantis.

But Suarez said Trump also has been kind to him. The two spoke at a wedding recently, he said, and Trump told him he was the "hottest politician in America after him."

"I don't know if he meant physically hot or if he meant I was getting a lot of buzz," Suarez said. "But he was very nice."

Suarez is of Cuban descent and leads the National Conference of Mayors. When asked about how he might stand out in a presidential race, Suarez said he might be able to speak to "a variety of minority communities that are going to be important if Republicans want to grow their base for a generation."

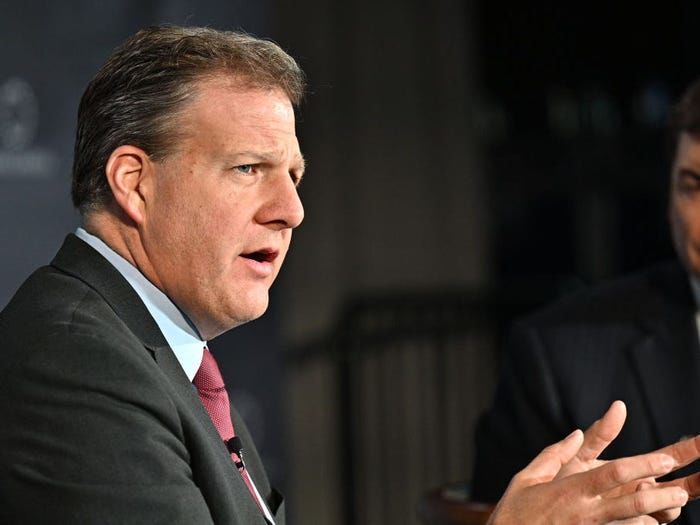

Gov. Chris Sununu of New Hampshire

Sununu, 48, was just reelected to a fourth term in New Hampshire, where governors are reelected every two years and there are no term limits.

"I haven't ruled anything in or out," he told Politico's "Playbook Deep Dive" podcast when asked about running for president in 2024. "I haven't ruled out a fifth term. I haven't ruled out running for higher office."

Sununu is a centrist Republican who has the distinction of being in favor of abortion rights, at a time when many states are banning abortion.

He came close to running for the US Senate in 2022, but told the Washington Examiner that other senators told him their main job was to be a "roadblock" in office — and he wasn't interested in that.

Sununu also called Trump "fucking crazy" at the Gridiron dinner, a journalism event.

"Let's stop supporting crazy, unelectable candidates in our primaries and start getting behind winners that can close the deal in November," Sununu said in November at Republican Jewish Coalition meeting.

He told the Washington Examiner after the midterms that there should be new GOP leadership — not just in the White House but inside the Republican National Committee.

"Did they achieve on the level of results that we all thought we were going to get?" he asked. "No. So, why would we stick with the same team assuming we're going to get a better result?"

Sununu is part of a political dynasty. His father was governor of New Hampshire who then went on to work in the George H.W. Bush administration as chief of staff. His brother was in the US House and US Senate.

Gov. Glenn Youngkin of Virginia

Gov. Glenn Youngkin of Virginia.

Gov. Glenn Youngkin of Virginia.

Youngkin, 56, tried his hand at playing kingmaker in over a dozen 2022 gubernatorial contests and mostly came up short.

The newly-minted Republican who rocketed to stardom in late 2021 by keeping Virginia purplish with his electrifying win over Democratic fixture Terry McAuliffe tried to work that same Trump-light magic into contests all around the country.

The result: only four of the 15 Republican gubernatorial candidates Youngkin got involved with won their races. It's unclear whether Youngkin had any effect on the reelection bids of blowout winners like Kemp or Noem.

By the same token, it's debatable whether he could have dragged Lake, Michigan's Tudor Dixon, or any of the other 2020 election deniers across the finish line given their full-on embrace of Trumpism.

While he remains reluctant to badmouth the embattled former president, Youngkin clinched his 2021 win by keeping Trump at bay while still reaching out to the MAGA base. Trump, on the other hand, has tried to take full credit for Youngkin's win and lashed out at the newcomer for not being more appreciative.

Trump's already working on trying to clip a Youngkin presidential bid from ever taking wing, panning him and DeSantis as ingrates who have no chance of beating him. Trump also reverted to his old tricks after the politically damaging 2022 midterms flop, hitting Youngkin with a bizarre, racist rant on Truth Social.

Given that Virginia only allows governors to serve non-consecutive terms, it makes sense for Youngkin to seek opportunities elsewhere.

The Washington Post reported that Youngkin spent part of his summer huddling with Republican mega donors in New York. And while he remains mum on any official plans for 2024, Politico said Youngkin's putting in place the types of fundraising groups a presidential candidate would want to have at the ready.

Youngkin is a former co-CEO of the Carlyle Group. As governor, his first official action was to sign an executive order prohibiting Virginia schools from teaching "critical race theory." More recently, he's been pushing to reimburse individuals and businesses who paid fines for violating state COVID-19 restrictions under his Democratic predecessor.