Uber Technologies Inc. is planning to invest approximately US$100 million in the Hong Kong share offering of Pony AI Inc., as part of a broader move to deepen its partnership with leading Chinese robotaxi firms. In parallel, the company is also expressing interest in an investment in WeRide Inc.’s Hong Kong listing.

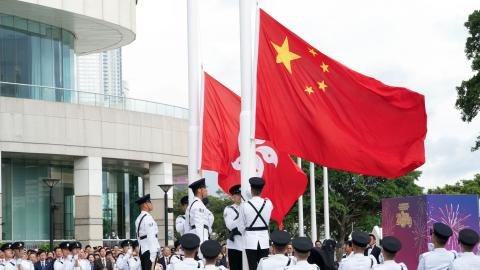

Pony AI and WeRide, both already listed in the United States, each received regulatory approval from China’s securities regulator for secondary listings in Hong Kong, enabling them to raise capital in the region. Pony AI is targeting up to US$972 million in its offering, while WeRide is raising as much as US$398 million. The potential Uber investment in Pony AI’s deal underscores its strategic commitment to autonomous-driving technology and global expansion.

The move strengthens Uber’s existing ties with both firms: the company has already invested in their U.S. initial public offerings and partnered with them in regions including the Middle East. By aligning with Chinese AV companies, Uber is positioning itself to access advanced robotaxi platforms and gain footholds in new markets across Asia and beyond.

While the exact structure of the investment in WeRide has not been disclosed, the potential backing signals Uber’s ambition to play a central role in the commercialization of Level 4 autonomous-vehicle fleets. Industry analysts view these listings as critical milestones for the companies to scale operations and achieve profitability targets in the coming years.

Observers note that confidence from global partners such as Uber may bolster investor sentiment for the Hong Kong offerings, which come amid a resurgence of listings in the territory and a shifting global capital-markets landscape. The deals—if realised—could reshape the competitive dynamics in autonomous mobility and reflect the growing global ambitions of Chinese robotaxi developers alongside established players.

For Uber, the proposed investment represents a calculated extension of its platform strategy—leveraging external autonomy capabilities rather than building in-house—while for Pony AI and WeRide it offers a pathway to deeper market access and validation as they scale toward commercial deployment of robotaxi and robotruck services.

As the listings proceed and regulatory clearances converge, the partnership matrix between Uber, Pony AI and WeRide is likely to become a defining axis in the robotaxi sector’s global rollout in the years ahead.