Its shares rose up to 4.7% on first day trading.

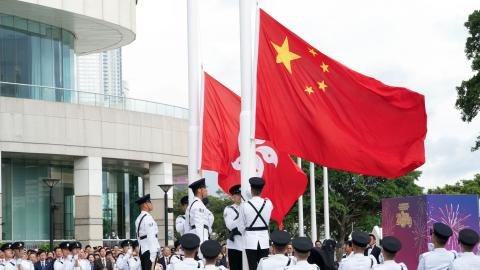

The listing is symptomatic of a broader surge of “A+H” dual listings—where Chinese mainland-listed companies also list in Hong Kong—according to multiple market data sources.

As of mid-2025, the city had seen proceeds from IPOs rise more than 700% year-on-year in the first half, led by large mainland names targeting global capital.

What sets this wave apart is its industrial composition.

Alongside Sany, other major new listings include companies in high-end manufacturing, new energy and biopharmaceutical sectors.

This reflects an intentional shift from China’s traditional export-manufacturing model toward innovation-driven growth, brand export and global production integration.

Hong Kong’s role is pivotal: the city offers Mainland firms an international fundraising platform, a broader investor base and a clearer governance structure aligned with global norms.

For firms, funds raised are earmarked for overseas research & development centres, technology acquisitions and global expansion rather than purely domestic growth.

Policy reforms in Hong Kong have underpinned this transformation.

The HKEX and regulators introduced mechanisms tailored to innovative and dual-listed firms, such as the Technology Enterprises Channel and streamlined filing processes.

Meanwhile, the number of listing applications exceeded 200 by mid-year, a record high.

This trend underscores not only Hong Kong’s resurgence as a global capital hub, but also China’s manufacturing sector moving up the value chain—from scale-based export to sophisticated, global brands.

For the global investor community, this revival offers access to China’s frontier industries through one of the world’s most open listed markets.

Market watchers caution that while momentum is strong, risks—such as geopolitical tensions, regulatory shifts and valuation pressures—remain.

Nonetheless, the current wave of IPOs in Hong Kong is being interpreted as more structural than cyclical, signalling a strategic repositioning of both the city and China’s corporates on the global stage.