Industry executives and recruiters concede that routine tasks once assigned to junior staff are increasingly automated, meaning that early-career roles are evolving or disappearing.

Yet some senior figures argue the change is not purely negative: those graduates who emerge with the right skills may progress more quickly.

In the assessment of Jacky Leung, Head of Hong Kong Coverage at Goldman Sachs and Co-Chief Operating Officer for Technology, Media and Telecoms (Asia-ex-Japan), the automation of foundational tasks means “individuals need to have a head start and prepare for the next level.

This shift makes the job more interesting and fulfilling at an earlier stage.”

The hidden consequence is a narrower funnel for new entrants: banks now seek candidates who can combine domain knowledge—frontend wealth or risk operations—with data-literacy and an ability to work alongside machine intelligence.

While this trend may reduce the number of traditional trainee roles, it intensifies demand for graduates who are alumni of STEM programmes, have familiarity with data analytics or scripting, and are comfortable adapting in a hybrid human-machine workplace.

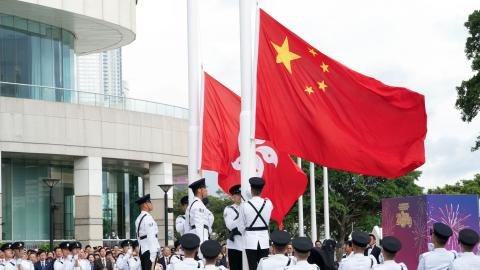

Policy and regulatory voices are already responding.

The city’s banking supervisor has released updated guidelines urging institutions to map the impact of technology on manpower and ensure reskilling support for affected employees.

Concurrently, a survey of 147 banks found 97 percent anticipate AI adoption will be a key growth driver by 2030—and are prioritising staff who can deploy AI-enabled workflows across business lines.

The study also flagged a broader talent gap in green finance and Middle-East/ASEAN expertise.

For early-career finance professionals in Hong Kong, the message is clear: standard paths into banking are being re-written.

Graduates must now be comfortable with automation, able to engage with clients or systems at a higher level, and equipped to collaborate with AI tools.

Institutions that manage this transition may deepen their competitive edge, but the journey for many new entrants will require significant adjustment and proactive skill-building.